Blockchain Business News 15-21 March

This is the weekly wrap of Blockchain Business News for 15-21 March. Subscribe to get the blockchain news you need for your business!

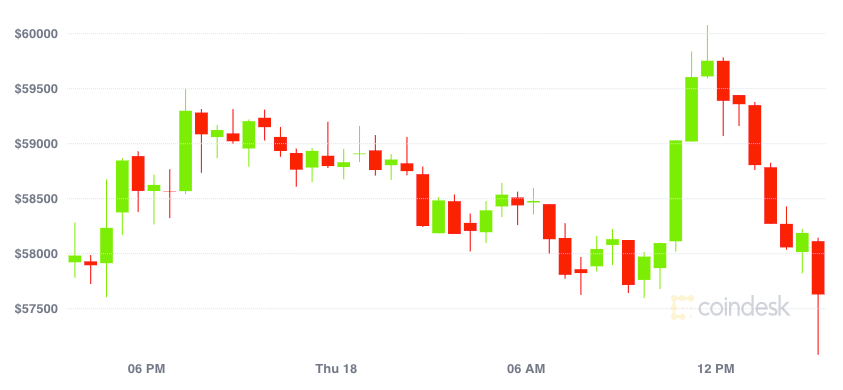

Bitcoin holds around $60K; will it get to $100K?

Over the past three months, the main cryptocurrency gained 3x in price.

Bitcoin began to actively grow in price after it had broken the $20K mark in December last year. On the night of March 18, 2021, Bitcoin price again approached the $60K mark.

Will it get to $100K this year? Experts say it’s highly likely because the conditions under which Bitcoin would grow twice more this year are already present.

One of the main reasons is the high demand for the first cryptocurrency from institutional players.

The second reason is the policy of the US Federal Reserve and the economic instability.

If the Stock-to-Flow scenario would continue to be realized, then the price of $100K per BTC is projected in late summer — early autumn 2021.

Crypto companies are booming

It’s been a good week for crypto companies.

BlockFi, a financial services startup for crypto, raised $350 million at a $3 billion valuation. Today, the startup has 265k+ retail and 200+ institutional clients, while monthly revenue has hit $50 million (vs. $1.5 million a year ago).

BlockFi also offers interest on crypto savings (6%+) and lends money against crypto holdings so people looking for liquidity don’t have to sell their assets (it has lent $10 billion + so far). The company also provides trade execution services to help organizations secure large blocks of crypto.

FalconX, another crypto trading platform that aims at institutions, raised $50 million. As Bitcoin surged over the past year, the platform saw its revenue increase 46x.

Cryptocurrency exchange Coinbase has reached an implied $68 billion valuation ahead of its highly anticipated direct listing on the Nasdaq. Coinbase’s first filing in February showed the company reported a profit of $322 million last year on net revenue that more than doubled to $1.1 billion (source).

India still undecided whether or not to ban cryptocurrency

Earlier this year, The Reserve Bank of India (RBI), the central bank of India whose primary function is to manage and govern the financial system of the country, had instructed banks to stop providing services to crypto trading platforms.

This move has led to uncertainty about the status of virtual currencies in India. Add to this the fact that existing laws are inadequate to deal with the subject and many rushed to the conclusion that India will ban crypto transactions.

Last week, finance minister Nirmala Sitharaman has made it clear that there will not be a complete ban on cryptocurrencies or at least the technology part of it. As per statement, the Indian government will soon take a decision on cryptocurrencies.

RubiX Blockchain Green Initiative to solve Bitcoin’s carbon emission problem

Bitcoin’s price has skyrocketed in the last year and so have its carbon emissions.

According to experts, Bitcoin has a carbon footprint comparable to that of New Zealand, producing 36.95 megatons of CO2 annually. And it consumes as much power as Chile. It’s a problem Bitcoin needs to address as soon as possible.

RubiX, a full-scale Blockchain-as-a-Service (BaaS) and security solutions company, announced last week that it is now providing a solution.

RubiX’s Blockchain Green Initiative provides an enterprise level Zero Carbon Footprint blockchain alternative.

This alternative is cryptographically 1,000,000 times more secure than the encryption used by Bitcoin or Ethereum.

“Our goal was to cut down the Carbon Emissions caused by Bitcoin and other Proof of work (PoW) based blockchain mining activities, using a secure proof-of-harvest alternative that’s cryptographically superior to the current blockchain platforms,” says Chakradhar Kommera, Chief Technology Officer at RubiX.

Does your brand cater to the needs of GenZ? Reach out to them through Yeay!

Yeay is a video platform providing teens with a space to share and shop styles.

The platform also provides brands with a marketplace to reach 13-18 year old.

Yeay launched in 2016 and a year later raised $4.9 million.

In 2018, the platform partnered with WOM Protocol to monetize peer-to-peer recommendations. WOM is a blockchain-powered advertising system that leverages the most effective form of marketing: honest word-of-mouth recommendations.

Yeay users get rewarded with WOM tokens for authentic and honest recommendations that are valuable to the community. They can use WOM Tokens to get cool stuff or turn them into cash.

Last week, the platform launched the YEAY House to give lifestyle influencers and their GenZ audiences a new way to monetize content while driving consumer blockchain adoption.

For the next month, a collective of lifestyle and crypto influencers with a combined reach of more than 40 million followers will be living, working and creating content together in the latest Los Angeles collaboration house. The influencers will be sharing their lifestyle by recommending the brands and products they love on the app and monetizing their content based on engagement after it has passed authentication.

Jack Ma’s Ant Group leads the way in blockchain patents

Ant Group, founded by Jack Ma in 2014 is an affiliate company of the Chinese Alibaba Group. The group owns Alipay, China’s largest digital payment platform which serves over one billion users and 80 million merchants.

AntChain is Ant Group’s self-developed financial-grade consortium blockchain platform.

The platform provides users with a high level of performance, reliability, and security. Specifically, it boasts 1 billion transactions for up to 1 billion accounts per day. The platform ranks first in the world by the numbers of patent applications and licenses. IBM, the only non-Chinese company in the top 10, ranked at #4.

Join the Conversation

We’d love to hear what you have to say.

Get in touch with us on our LinkedIn Page, Facebook Page, Twitter or TikTok.

Blockchain Business News 8-14 March

This is the weekly wrap of blockchain business news for 8-14 March. Subscribe to get the blockchain news you need for your business!

An NFT Digital Artwork Just Sold For $69 Million

Last week, Christie’s sold the first purely digital artwork ever offered by an auction house.

The artwork is called Everydays: The first 5000 days and was created by digital artist Mike Winkelmann aka Beeple.

The piece is one massive image that contains every single everyday that he has done from May 1st 2007 to January 7th, 2021. ⠀

The NFT-based digital artwork sold for a whopping $69 million making Beeple the third most-valuable living artist in the world behind David Hockney and Jeff Koons.

View this post on Instagram

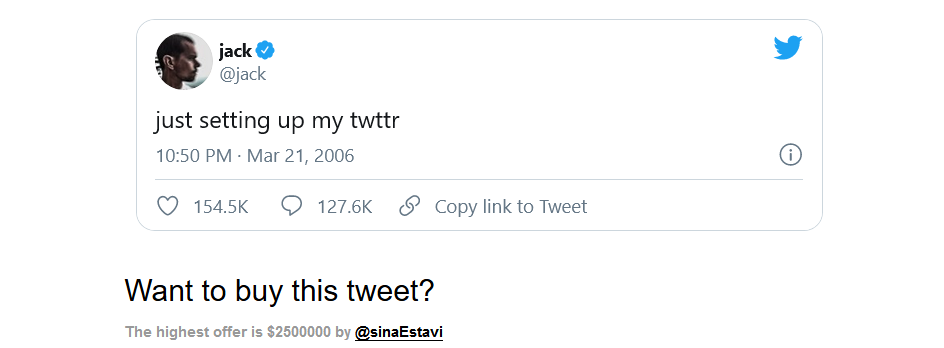

Thanks to NFTs, you can become the owner of a digital artwork, an NBA shot or a tweet.

Wait, a tweet?

Yes!

And not just any tweet, Jack Dorsey’s first tweet in 2006.

The auction is set to end on March 21. Jack announced he will donate the proceeds to Give Directly’s Africa Response fund for COVID-19 relief.

The highest bid for the tweet is currently $2.5 million.

Blockchain firm Ripple to end partnership with MoneyGram

In 2019, MoneyGram and blockchain firm Ripple announced a partnership where MoneyGram will distribute Ripple’s digital currency XRP across the world and Ripple will invest up to $50 million in MoneyGram. XRP, Ripple’s digital currency is the world’s third most valuable cryptocurrency after Bitcoin and Ethereum.

In its announcement, MoneyGram said it would use Ripple’s xRapid liquidity product to help process cross-border payments for an initial term of two years. As for Ripple, the main benefit of this deal is increased credibility for its digital currency.

Two years later, the companies have decided to end their partnership agreement.

In its statement, Ripple said:

We are proud of the work we were able to accomplish in a short amount of time, as well as the impact we were able to achieve in bringing this first-of-its-kind product to market. Together, we processed billions of dollars through RippleNet and On-Demand Liquidity (ODL).

We are both committed to revisiting our relationship in the future. We still believe in the promise of digital assets and blockchain technology to change the status quo in global payments for the benefit of billions of consumers around the world.

PayPal steps up crypto efforts with acquisition of blockchain security startup Curv

PayPal announced last week that it has agreed to acquire Curv to accelerate and expand its initiatives to support cryptocurrencies and digital assets.

Curv is a leading provider of cloud-based infrastructure for digital asset security based in Tel Aviv, Israel.

PayPal, now boasting 375 million consumers and $2.4 billion in profit for 2019, said in its statement that “The acquisition of Curv is part of our effort to invest in the talent and technology to realize our vision for a more inclusive financial system.”

Last year, PayPal announced its commitment to help shape the role that digital currencies will play in the future of financial services and commerce.

Blockchain.com Crypto Wallet outage affects ‘large number’ of users

On March 9, Blockchain.com, the world’s oldest crypto company, experienced an issue that prevented its users from accessing their wallets.

Upon investigation, the company reported that a fire at one of their many data centers had caused the outage. The issue was fixed eight hours later with wallet functionality being fully restored.

The demand for internet-based services has increased over the past few years. Businesses are now adopting cloud services and advanced technologies for operation, data storage and other related work. Blockchain technology is now a significant driver for data centre demand.

With data centres growing bigger and more powerful, the rate of fire incidents is also increasing. To prevent the type of outages that Blockchain.com experienced last week, data centers operators must adopt fire detection and suppression systems.

As this report mentions, the cost of IT equipment and downtime of the server room is much higher than the cost of the fire suppression system.

Blockchain.com to leverage the business experience and clout of Jim Messina, Obama’s former political and corporate adviser

Blockchain.com was launched in 2011. In the past decade, the company developed a popular cryptocurrency wallet as well as an exchange and an explorer.

According to the latest statistics, people have created 65 million wallets on the company’s website or using mobile apps. Since 2012, 28% of bitcoin transactions have been sent or received by a Blockchain.com-managed wallet. In February 2021, the company raised a $120 million funding round.

Jim Messina

Who is Jim Messina and why does Blockchain.com need his expertise?

Jim Messina is one of the world’s most successful political and corporate advisors.

He is the mastermind behind President Obama’s 2012 re-election campaign. Before crafting the strategy that would get President Obama re-elected, he spent a month learning organizational growth, marketing and emerging technologies from the CEOs of some of the most successful companies in the US: Apple, Facebook, Microsoft, Salesforce etc.

The press release announcing that Jim Messina will be joining the Blockchain.com Board of Directors also mentions the reason behind this decision:

“Jim’s experience and guidance will be invaluable as we navigate the process of bringing crypto to the first billion people.”

Australia’s Government Allocates $5.3M for Blockchain Pilot Projects

The government of Australia has allocated $5.3 million to the Department of Industry, Science, Energy and Resources to study the role blockchain technology can play in regulation.

The money will be spent on two pilot projects intended to show how cost reductions in regulatory compliance are possible with the use of blockchain. The projects will focus on the supply chains of critical minerals and food and beverages.

This news is not surprising with Australia being one of the top leading countries in blockchain technology.

Last year, Australia released its 5-year National Blockchain Roadmap in which it said it was exploring the potential benefits of blockchain to create new economic growth and improve productivity.

The roadmap delves into three main industries which it believes would benefit from applying blockchain: the agricultural sector, the education sector and the financial services sector.

Join the Conversation

We’d love to hear what you have to say.

Get in touch with us on our LinkedIn Page, Facebook Page, Twitter or TikTok.

Blockchain Business News 15-21 February

Stay updated with the latest blockchain news in business – subscribe to our blog notifications!

Crypto wallet and exchange company Blockchain.com raises $120 million

Blockchain.com is a cryptocurrency blockchain explorer service, as well as a cryptocurrency wallet and a cryptocurrency exchange supporting Bitcoin, Bitcoin Cash, and Ethereum.

The company also offers a full-stack crypto services platform providing crypto native businesses with institutional scale custody, execution, lending, and structured solutions.

Launched in 2011, Blockchain.com is one of the most popular crypto platforms in the world with 68 million wallets making $620 billion in transactions. CEO and co-founder Peter Smith says 28% of all Bitcoin transactions since 2012 have occurred via Blockchain.com.

Last week, the company announced that it has raised a $120 million funding round from some of the world’s leading macro investors including Google.

Our mission is to empower anyone anywhere to control their money and we’re just getting started. (..) We’re thankful to the millions of Blockchain.com users who have grown with us over the years. Paradigm shifts like crypto can feel to the world as though they happened overnight — but for those of us working day in and day out to build technology and innovation in crypto, this has been a long time coming. I couldn’t be more optimistic about the future, but there’s so much more to do. It’s time to bring billions of people into crypto and millions of institutions around the world. It’s time to build a financial system for the internet.

Peter Smith, Blockchain.com CEO and co-founder

Should HR managers explore the possibility of using cryptocurrency as the mode of payment for payroll?

Blockchain.com is the latest company to raise a big funding round and others will surely follow. It’s a powerful signal that things are changing in the financial world and companies and institutions are becoming serious about developing a crypto strategy.

Tesla has bought bitcoins worth $1.5 billion and is offering to accept payments through bitcoins for its products. Online commerce has experienced unprecedented acceleration and in Australia, the first standardised digital bank guarantee was announced. In five years, the blockchain technology market is expected to grow by 63%.

Maybe it’s time HR managers explore the possibility of paying employees in the cryptocurrencies of their choosing.

It’s an important change. Here are some advantages that HR managers hiring overseas would appreciate:

- Attract more talent in countries where the currency is devalued or the banking systems are not reliable;

- No intermediary banks needed for paying these employees;

- No fluctuations in exchange rates;

- Short lead times required to confirm payments.

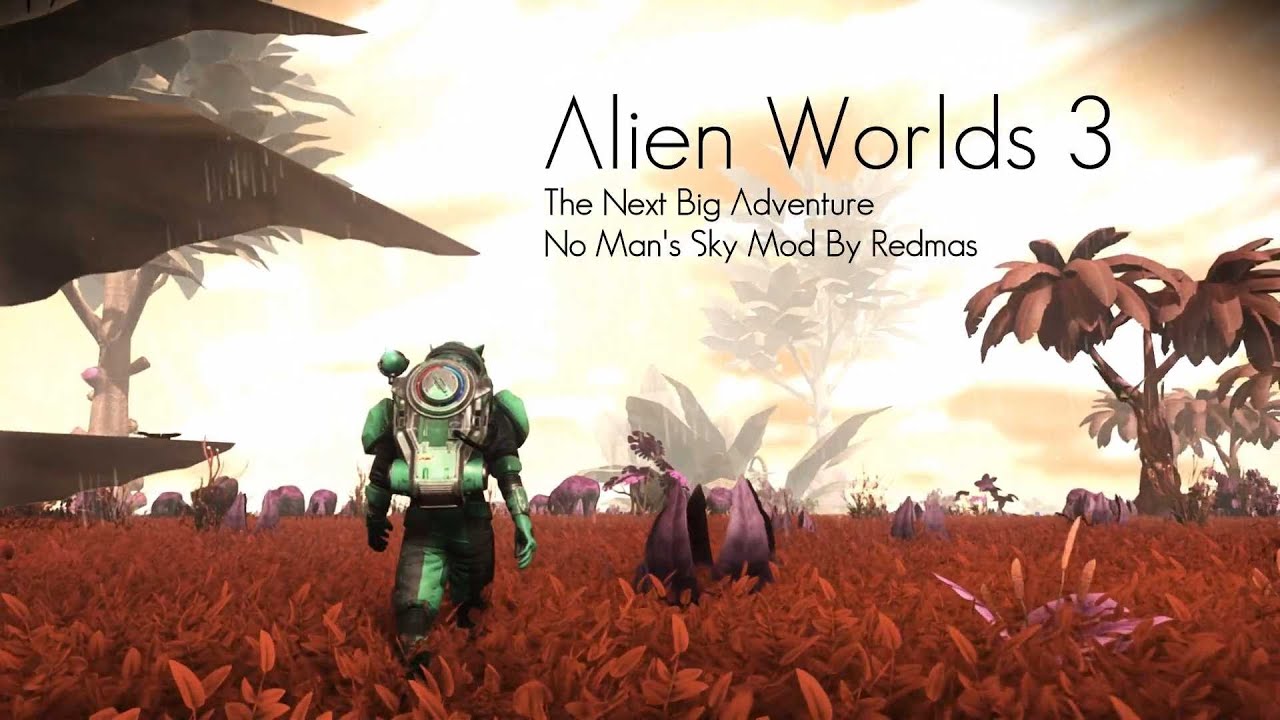

Blockchain game Alien Worlds players can make as much as $300 or more a month

Alien Worlds is one of the leading blockchain games on the market.

Trilium, Alien Worlds’ native currency, has driven users to the game and catapulted it to the number one ranked decentralized game by user base. The game is currently hosting over 13,000 players and close to 20 million in-game transactions.

Blockchain has allowed gamers to capitalize on their hobbies, ushering in a world where people of all skill levels can monetize their hobbies.

On average, Alien Worlds players are making anywhere between $60 to $300 per month. Top Alien Worlds players are pulling in about $35,000 per month.

Supported by leading private bankers, the Blockchain Association For Finance was launched last week in Switzerland

The Blockchain Association for Finance is a new association dedicated to the blockchain.

Launched in Switzerland, the world’s largest offshore wealth centre, the Blockchain Association for Finance is a nonprofit organization bringing together financial actors to improve compliance and administrative exchanges thanks to technology.

The association brings together several major private bankers such as Banque Pictet, Lombard Odier and Hyposwiss.

At the origin of this initiative is Wecan, a Geneva-based fintech founded in 2015. With around 20 employees, the company, which specialises in blockchain solutions, manages the Wecan Comply blockchain infrastructure, which is currently used by the members of the new association.

You can now access blockchain domains using any web browser

.com domain names are housed on a server, run on a subscription basis, and are managed by an organization called Verisign.

Blockchain web domains are different from their traditional counterparts. They are purchased for a one-off fee and are not overseen by any single, centralized authority.

Until now, the only way to access blockchain websites was via a plug-in or a browser that already offers native support, such as Opera.

Blockchain domain registry Unstoppable Domains has changed that. The company now offers a new service that expands access to .crypto websites to anyone with an internet connection.

An additional benefit is that owners of cryptocurrency wallets can use their blockchain domain to send and receive cryptocurrency without having to remember a long and complex alphanumeric address. To deliver a crypto payment, the sender would only need to know your human-readable domain name.

Thanks to blockchain, Christie’s will sell the first-ever digital artwork

Digital art is an artistic work or practice that uses digital technology as part of the creative or presentation process.

This form of art began in the 1960s. Pioneering artists Harold Cohen, Kenneth Knowlton and Leon Harmon were among the first to create digital art.

Knowlton and Harmon took a photograph of a nude woman and changed it into a picture composed of computer pixels. The picture was titled Computer Nude (Studies in Perception I) and is the most widely circulated early artwork made using a computer.

Artists Knowlton and Harmon in front of Computer Nude (Studies in Perception I), the first digital artwork

Major auction house Christie’s is no stranger to blockchain. In 2018, they became the first auction house to record a major sale on a blockchain platform. In partnership with art registry Artory, the company recorded $317m of sales digitally and securely.

This month, Christie’s will open bidding for an online-only sale of ‘Everydays – The First 5000 Days’ by prominent digital artist Mike Winkelmann, known online as Beeple.

Before blockchain, it was impossible to assign value to digital works of art given the ease of duplication. Now, every digital artwork can benefit from a unique digital token encrypted with the artist’s signature called NFT or a non-fungible token. The NFT is individually identifiable on a blockchain, verifying both the rightful owner and authenticity of original digital creation.

Blockchain adoption in the real estate closing industry is gaining traction

The Blockchain-secured platform for real estate and title recordkeeping Ubitquity has partnered with Socratic Consultancy to gain more insight into and further traction in the U.S. real estate closing industry.

Socratic Consultancy has close to a decade of experience in the real estate closing industry, including the specific niche markets of eRecording and Remote Online Notarization (RON).

The partnership pushes forward blockchain adoption in the real estate closing industry.

Ian T. Staley, the CEO and Founder of Socratic Consultancy said blockchain technology will provide the industry with “enhanced efficiency, increased security in the transaction process, less friction and increased agility in the closing lifecycle, parallel recordkeeping data storage, alternative revenue streams for its partners, future-proofed settlement solutions and so much more!”

Quote of the week

Abigail Johnson, CEO of Fidelity Investments

Blockchain technology isn’t just a more efficient way to settle securities. It will fundamentally change market structures, and maybe even the architecture of the internet itself.

Abigail Johnson, CEO of Fidelity Investments, one of the most powerful women in finance

Join the Conversation

We’d love to hear what you have to say.

Get in touch with us on our LinkedIn Page, Facebook Page, Twitter or TikTok.

Libra is Facebook’s new cryptocurrency

What is Libra?

Find out all you need to know about Facebook’s new cryptocurrency.

Join the Conversation

We’d love to hear what you have to say.

Get in touch with us on Facebook Group and Twitter.

Blockchain and cryptocurrency: what’s the difference?

What is blockchain?

Blockchain is a digital ledger in which transactions made in Bitcoin or another cryptocurrency are recorded chronologically and publicly. It allows digital information to be distributed but not copied.

Many have compared the blockchain with a spreadsheet: the spreadsheet is duplicated thousands of times across a network of computers and this network is designed to regularly update this spreadsheet. The blockchain is transparent and cannot be corrupted, it isn’t controlled by any single entity and it is not flawed.

What is cryptocurrency?

The cryptocurrency is a digital currency in which encryption techniques are used to regulate the generation of units of currency and verify the transfer of funds, operating independently of a central bank.

Bitcoin is the first cryptocurrency or “digital gold”. But unlike USD or EURO, cryptocurrencies are not issued by a bank or owned by a country, don’t fall under the influence of political regimes and are private and anonymous enough to be used as means of payment worldwide. Bitcoins can be traded for goods or services with vendors who accept Bitcoins as payment.

A Short History of Blockchain and Cryptocurrency

Blockchain is a technology invented and developed by a person or a group of persons known as Satoshi Nakamoto.

In October 2008, Nakamoto published “Bitcoin: A Peer-to-Peer Electronic Cash System”, the first paper describing the bitcoin digital currency.

In January 2009, Nakamoto released the first Bitcoin software that launched the network and the first units of the Bitcoin cryptocurrency, called Bitcoins. Nakamoto created a website with the domain name bitcoin.org and continued to collaborate with other developers on the Bitcoin software until mid-2010. Around this time, he handed over control of the source code repository and network alert key to Gavin Andresen, transferred several related domains to various prominent members of the Bitcoin community, and stopped his involvement in the project. Until shortly before his absence and handover, Nakamoto made all modifications to the source code himself.

How does blockchain and cryptocurrency work?

The blockchain is a digital technology that allows value exchange without the need for trust or for a central authority. It is a secure, quick and cheap technology. As mentioned in its definition, blockchain uses a ledger, which is a digital file that keeps track of all Bitcoin transactions.

The ledger file is not stored in a central entity servers, like a bank, or in a single data center. It is distributed across the world via a network of private computers that are both storing data and executing computations. Each of these computers represents a “node” of the blockchain network and has a copy of the ledger file.

In order to be able to perform transactions on the blockchain, you need a wallet, a program that allows you to store and exchange your Bitcoins. Since only you should be able to spend your Bitcoins, each wallet is protected by a special cryptographic method that uses a unique pair of different but connected keys: a private and a public key.

Once you have installed a Bitcoin wallet on your computer or mobile phone, it will generate your first Bitcoin address and you can create more whenever you need one. You can disclose your addresses to your friends so that they can pay you or vice versa. In fact, this is pretty similar to how email works, except that Bitcoin addresses should only be used once.

Here is a short explaining video:

Top Technology Trends in 2018

The last decade has been undoubtedly under the sign of technology, each year its imprint being stronger and stronger and blurring more and more the lines between fiction and reality.

From AI and VR to the IoT ,companion robots,5G and smart cars, here are the top 18 trends from CES this year, as related by Forbes.

According to DXC.technology, there are 6 big trends coming our way in 2018: re-platforming the enterprise, the war for digital talent becoming creative and vigorous, qualified enterprises, cyber resilience,companies growing thanks to digital business extensions and artificial intelligence getting smarter and more practical. The detailed information can be found here.