What is the BCG Growth-Share matrix and why you should use it in your business?

The BCG Growth-Share matrix is the sixth business framework showcased in our BUSINESS reSOURCES series. Check the previous five: Porter’s 5 Forces, PESTEL, Hofstede’s Cultural Dimensions theory, the Porter Diamond Model and the McKinsey 7S model.

What is the BCG growth-share matrix and why should you use it in your business?

The growth-share matrix is a business framework that helps companies analyze their business units (i.e. their product lines) or any other cash-generating entities by their degree of profitability.

The matrix was created in 1970 by management expert Bruce Henderson, founder of Boston Consulting Group (BCG), one of the most influential strategies consulting organizations in the world.

Also known as the BCG growth-share matrix, this business analytical tool provides the company with a four-quadrant chart where products are ranked on the basis of their relative market shares and growth rates.

The company then decides where to allocate resources and which products to prioritize.

What are the 4 quadrants of the BCG matrix?

Let’s dive deeper and learn more about the four quadrants of the matrix.

The 4 quadrants of the BCG growth-share matrix are “cash cows”, “dogs”, “question marks” and “stars”.

BCG growth-share matrix – Cash cows

Cash cows are products in low-growth areas for which the company has a high market share.

These products generate large amounts of cash that are higher than the market’s growth rate. Also, the revenues generated by these products exceed the amounts reinvested to maintain share. These products are the company’s most profitable and they should be milked for cash for as long as possible.

BCG growth-share matrix – Dogs

Products with a low market share in areas with slow growth are dogs.

They may show an accounting profit, but the profit must be reinvested to maintain share which in the end, leaves the company with empty pockets or even negative cash returns. Companies should investigate further to determine if these products are profitable in the long run or they should be liquidated.

BCG growth-share matrix – Question marks

The Question marks in the company’s portfolio are the products with a low market share in a high growth rate market.

These products typically grow fast and have the potential to become stars. But before they reach this stage, question marks almost always require far more cash than they can generate. Companies should investigate these products and the market circumstances to determine if they are worth maintaining in their portfolio.

BCG growth-share matrix – Stars

Stars are products with a high market share in a high growth rate market.

They generate cash and use cash at the same time. Companies should invest in stars to support their further growth as they are expected to become cash cows. Depending on the characteristics of the market these products live in, they could become cash cows or they could turn for the worst and become dogs.

Every company needs products in which to invest cash. Every company needs products that generate cash. And every product should eventually be a cash generator; otherwise, it is worthless.

Only a diversified company with a balanced portfolio can use its strengths to truly capitalize on its growth opportunities.Bruce Henderson, creator of the BCG growth-share matrix, an excerpt from The Product Portfolio

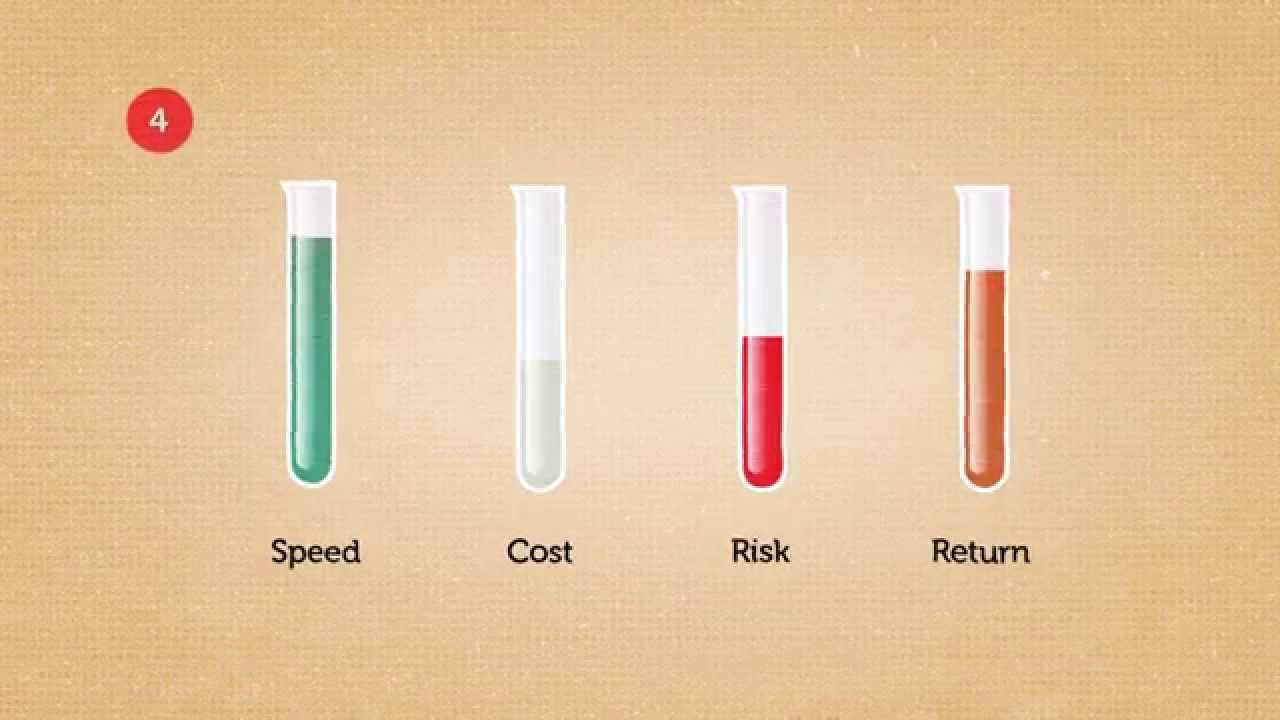

Here is a short explanation of the BCG growth-share matrix:

How do you use the BCG growth-share matrix?

If you are a business owner or developer, use the BCG growth-share matrix to determine the nature of your company’s portfolio.

Do you have a cash cow? How many questions marks does your company invest resources in? Are there any dogs in your portfolio? How about stars?

It’s necessary to acquire a clear picture of your products in order to make the right decisions.

You need to first choose the product to which you will apply the matrix, define the market of your product, calculate the market share and find out the growth of the market.

After you have gathered all the needed information, you can determine which quadrant of the BCG growth-share matrix your product belongs to.

If your product is a cash cow, milk it for everything it’s got. Don’t reinvest the revenue back into the cash cow! Use it to grow a question mark into a star or a star into a cash cow.

If your product is a dog, perform a deeper analysis to determine whether or not it should be liquidated. Please note dogs are not to be invested in!

Is your product a question mark? If it is, do you have the necessary resources to help it become a star? And is the effort worthwhile for your business?

Is your product a star? Then invest your resources to help the product become a cash cow.

Join the Conversation

We’d love to hear what you have to say.

Get in touch with us on our LinkedIn Page, Facebook Page, Twitter or TikTok.

McKinsey 7S model of Nokia – where the company went wrong

From a cell phone pioneer to being acquired by Microsoft in 2013, Nokia is a case study of organizational failure. Let’s analyze where the company went wrong by applying McKinsey 7S model.

McKinsey 7S model is a business framework which can be used to analyze organizational effectiveness. According to the McKinsey model, the organization is a complex ecosystem consisting of seven interconnected factors: Structure, Strategy, Skills, Staff, Systems, Style and Shared Values.

The model is also a blueprint for organizational change.

To show you how you can use the McKinsey model 7S for the benefit of your organization, I will analyze mobile pioneer Nokia at the time of its demise, namely 2011-2013.

Here’s a brief background story:

In October 1998, Nokia became the best-selling mobile phone brand in the world with an operating profit of almost $4 billion. The best-selling mobile phone of all time, the Nokia 1100, was created in 2003. Five years later, Apple introduced the iPhone. By the end of 2007, half of all smartphones sold in the world were Nokias, while Apple’s iPhone had a mere 5% share of the global market.

In 2010, attempting to drive Apple out of the market, Nokia launched the “iPhone killer”. The model failed to achieve its goal and was the beginning of the end for Nokia. From that moment on, Nokia embarked on a downward spiral of low-quality phones. In just six years, the market value of Nokia declined by about 90%. The organization was acquired by Microsoft in 2013.

Now that you’re familiar with Nokia’s failure story, let’s analyze the organization before Microsoft made its move to acquire it by applying the McKinsey 7S model.

In my opinion, here are the factors that required immediate change: Structure, Style, Skills, Staff and Strategy.

McKinsey 7S model of Nokia

McKinsey 7S model of Nokia – Structure

Nokia of the era was a top-down line structure organization.

In public speeches given by the organization’s top executives, agility and being nimble were mentioned as key competitive advantages.

But it was all talk. The organization’s top management was living in a bubble, disconnected from the company’s technology development departments. Communication was one-way and teams were not empowered to contribute to the organization’s strategy.

To adapt to the new technological environment and compete with Apple, a powerful tech company, Nokia should have taken steps to change its structure from top-down hierarchical to decentralized and agile.

Instead of organizing employees in silos, with no communication and collaboration between them, the company should have placed its employees in teams, with every team working to achieve a common goal.

Team members should have been empowered to speak up, come up with solutions and work independently.

McKinsey 7S Model of Nokia – Style

In McKinsey’s model style refers to culture. What was Nokia’s culture at that time?

As per the 2015 paper Distributed Attention and Shared Emotions in the Innovation Process: How Nokia Lost the Smartphone Battle, Nokia suffered from organizational fear, status (We are no 1), in-house politics and temporal myopia.

Top managers had business backgrounds and lacked technological competence. Employee morale was low.

As the saying goes, culture eats strategy for breakfast. Top management should have adopted a transformational leadership style where the leader’s goal is to transform the organization so that it’s constantly improving.

Transformational leaders create a vision of the future that they share with their teams so that everyone can work together toward a shared goal and vision. Technology is ever-changing. Technology companies must embrace change in order to stand the test of time.

Transformational leadership would have been the best fit for Nokia because it fosters creativity and innovation through collaboration. This type of culture builds and maintains employee motivation and satisfaction and is effective in facilitating organizational change.

McKinsey 7S Model of Nokia – Skills

Nokia didn’t lack talent and didn’t have a skills gap in the company. There were no gaps in know-how or competence.

At its peak, Nokia had one of the top highly-skilled tech workforces in the world.

The company’s hardware and software engineers had designed one of the most successful and iconic cell phones in the world, there’s no doubt about it.

The problem was the top management. Between 2007 and 2010, the position of the Chief Technology Officer (CTO) disappeared from the top management team. Technical managers had left the company and new hires had no technical skills making it difficult for them to understand the technological challenges and the direction in which the company should be heading.

Conversely, top management members at Apple were all engineers. Nokia should have focused on increasing tech skills among C-level executives.

McKinsey 7S Model of Nokia – Staff

At Nokia, people were talking business instead of technology which is quite surprising for a software company.

The organization should have found ways to motivate and nurture its employees appropriately.

McKinsey 7S Model of Nokia – Strategy

Struggling to compete with Apple and adapt to the technological developments that were disrupting the business environment at that time, Nokia top management had to choose between three strategies: optimizing costs and volume, maximizing performance, or maximizing security.

They decided to go with cost optimization which made it impossible to achieve performance in software.

With Apple going for technological innovations and excellency, needless to say, they made the wrong decision.

Conclusion

At its peak, Nokia manufactured 40% of the world’s mobiles. The company had the human resources (skills and staff factors) required to keep innovating and increasing its market share.

Unfortunately, the company’s leadership (style factor) lacked core competences and vision necessary to drive change within the company.

They didn’t allow the tech talent in the company to contribute with valuable insights to important decisions. The company chose the wrong strategy which ultimately lead to its demise.

Join the Conversation

We’d love to hear what you have to say.

Get in touch with us on our LinkedIn Page, Facebook Page, Twitter or TikTok.

How to apply the PESTEL analysis to support your business vision

In this article:

- What is PESTEL business analysis?

- What does PESTEL acronym stand for?

- PESTEL factors explained

- When should you use PESTEL analysis for your business?

What is PESTEL business analysis?

PESTEL business analysis is a framework for helping entrepreneurs and business people to understand the impact of macro-environmental factors on their business.

What does PESTEL acronym stand for?

The PESTEL acronym stands for

![]() Political

Political

Economical

Economical

Social

Social

Technological

Technological

Environmental

Environmental

Legal

Legal

The PESTEL analysis was created in 1967 by Harvard Business School professor Francis J. Aguilar.

Francis J. Aguilar

PESTEL/PESTLE/STEEPLE – are they the same thing?

Yes, PESTEL, PESTEL and STEEPLE refer to the same business framework. The only difference is that the letters are switched between them. In the case of STEEPLE, the additional E stands for Ethics.

PESTEL factors explained

PESTEL is the second strategic tool for decision-making we are highlighting on the BRAND MINDS blog.

Our mission is to help you acquire relevant knowledge that will support you to make good business decisions. Learn how to grow your business with PORTER’S 5 Forces framework.

The factors analyzed by the PESTEL framework refer to the macro-environment of your business. Not to be confused with the external factors of your business.

Let’s think of your business as the Earth.

The Earth is made up of four layers: the inner core, the outer core, the mantle and the crust.

The inner core of your business is comprised of your business’s organizational structure, culture, employees, management and operations. They are the internal factors.

The next layer surrounding your business is the outer core: competitors, suppliers, distributors, customers and partners. They are the external factors. These factors and your business are in a two-way relationship – they influence each other. If you want to assess how much power your competitors or your buyers have on your business, apply PORTER’S 5 Forces framework. You will get a map of the industry your business operates in as well as the structural underlining drivers of profitability and competition.

The third layer of your business comes over the external factors and it’s called the macro-environment. The macro-environment includes the factors listed earlier in the article: political, economical, social, technological, environmental, legal.

Unlike the external factors, which your business can influence, the macro-environmental factors are outside the influence range of your business. But they do have the power to effect change on your business.

![]() PESTEL analysis – Political factor

PESTEL analysis – Political factor

The political factor helps you appraise the degree to which a government intervenes in the economy or a certain industry.

Look at how current, past, and future regulations currently affect the market in which your business operates.

Also, take into account whether or not there is political stability and what are the consequences of political instability over your business.

Is there corruption? What are foreign trade and tax policies?

PESTEL analysis – Economical factor

PESTEL analysis – Economical factor

The economical factor is the determinant of the economy’s performance.

Examine the economic growth, exchange rates, interest rates, unemployment rates, the state of the country’s infrastructure, taxes.

This factor affects the purchasing power of your customers and could change the demand and supply dynamics of the market. This, in turn, affects how your business prices its products and services.

PESTEL analysis – Social factor

PESTEL analysis – Social factor

The social factor analyzes the profile and behaviour patterns of your customers. In marketing, it’s called a buyer persona.

Gather as much information on the social aspect of your market as possible from standard demographics (age, sex, family status, professional background, education) to psychographics (pain points, dreams, goals, interests and hobbies).

Become aware of cultural differences between generations.

Is there a cultural movement that your customers are supporting? What are their values, customs and lifestyle choices? Which social media platform do they use the most?

PESTEL analysis – Technological factor

PESTEL analysis – Technological factor

Fifty-three years ago, when PESTEL was created, technology didn’t have the essential impact on the business and our world as a whole as it does today. But there were early signs. In 1967, the first message was sent over the internet and the GPS became available for commercial use.

Taking into account the way technology has been disrupting industries and changing business models in the last decade, this factor is one of the most important to look into.

Put together a list of the technologies impacting your industry.

Check the regulations surrounding technology in your market. Are they favourable or not favourable?

What is the rate of technological change and innovation? Is the industry dominated by automation? How costly is it?

PESTEL analysis – Environmental factor

PESTEL analysis – Environmental factor

As with the technological factor, the environmental factor is today of growing importance.

Businesses are now called to account for any negative impact their operations have on the environment.

Companies big and small are expected to reduce their carbon footprint, take actions to reduce waste and pollution, and preserve the environment.

How is your business affecting the environment? What can you change to make sure your business is sustainable and environmentally responsible?

PESTEL analysis – Legal factor

PESTEL analysis – Legal factor

The legal factor of PESTEL analysis looks into the laws and regulations of your industry.

Is your market regulated by a specific set of laws? How do they influence your business?

Also take into account other laws like discrimination, antitrust, employment, consumer protection and copyright laws.

When should you use PESTEL analysis for your business?

If you’re thinking about launching a new business, entering a foreign market or a different industry, PESTEL analysis framework is especially useful because it gives you an accurate overview of the macro-environment and how it affects your business.

Join the Conversation

We’d love to hear what you have to say.

Get in touch with us on our LinkedIn Page, Facebook Page, Twitter or TikTok.

BUSINESS reSOURCES: Grow your business with Porter’s 5 Forces framework

On this page:

- What is Porter’s 5 Forces business framework?

- How to evaluate Porter’s 5 Forces (explained)

- 11 Benefits of applying Porter’s 5 Forces framework to grow your business

- 6 recommendations for a successful business strategy

What is Porter’s 5 Forces business framework?

Porter’s 5 forces is a holistic way of looking at any industry and understanding the structural underlining drivers of profitability and competition.

Porter’s 5 Forces framework is a valuable business tool that helps entrepreneurs shape their strategy to drive profitability.

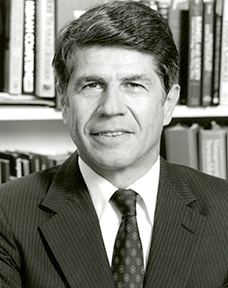

Business strategist Michael E. Porter

The framework was created by Michael E. Porter, an economist, researcher, author and Harvard Business School professor. His expertise focuses on market competition and company strategy. His extensive research is widely recognized in governments, corporations, NGOs, and academic circles around the globe.

Strategy can be viewed as building defences against the competitive forces or as finding positions in the industry where the forces are weakest.

Michael E. Porter

How to evaluate Porter’s 5 Forces (explained)

1. Existing rivals

Evaluate the existing rivals by looking at the number of competitors. Are there many competitors? How do they rate in terms of size and power? Are they clearly differentiated or are their products almost identical?

What is the size of the competitors?

What is the industry growth rate: slow or fast?

Is product differentiation between competitors present?

What about exit barriers: are they high or low?

2. Buyers

The buyers are powerful and can influence the industry if they make purchases in large volumes.

Is the product undifferentiated? If that’s the case, the buyer will be price-sensitive and the digital environment allows the buyer to instantly compare prices and choose the cheapest.

Is there a large customer base? Do they have many alternatives to buy from? When the buyers are interested in high quality, they are not price-sensitive.

3. Suppliers

How much control does a supplier have over your business?

Does it influence your business by raising the cost of their products and lowering quality?

How many suppliers are in the industry? The fewer they are, the more powerful they are to control the industry and influence your profit margin.

Factors in determining supplier power: number of suppliers and concentration, switching costs, availability of substitutes, uniqueness of product, whether or not the industry is an important customer of the supplier and its availability to cut out the middle man.

4. Substitutes

Substitutes are alternative products that fulfil the same need by different means. In the airline industry, the substitutes are trains and cars.

Rule of thumb: don’t limit your analysis to your industry. Expand your approach to products that meet the same need but are in different industries.

How many alternatives to your product are on the market?

How can you rate the buyers’ willingness to switch and choose a substitute instead of your product?

What is the price-performance ratio of the substitutes?

5. New rivals

Is the entry barrier low or high?

If the entry barrier is low, which means requirements to enter the industry are affordable or readily accessible, then there are increasing chances of new entrants in great numbers. In this case, the threat is high.

There are six major sources of barriers to entry: economies of scale, product differentiation, capital requirements, cost disadvantages independent of size, access to distribution channels and government policy.

In a future envisioned by Elon Musk, people will fly from New York to Shanghai in a rocket, not an airplane and it will take only 10 minutes instead of 24 hours. The downside of this type of futuristic fast-travel may prove to have a high price.

A different way of fast and affordable transportation shines brightly in the near future: the hyperloop. Read about the hyperloop.

11 Benefits of applying Porter’s 5 Forces Business Framework

If you have a great idea, the next step is not product development, logo design, or assembling the best team.

If you’re contemplating starting a business, the first thing you should do is industry analysis and look at the competitor environment before anything else.

And that’s why Porter’s 5 Forces framework is of paramount importance to any entrepreneur: it helps to design a successful business strategy that will support the business to achieve its goals.

11 benefits of applying Porter’s 5 Forces Business Framework

- Evaluate the roots of long-term profitability in your industry.

- Discover the trends that are most likely to be significant in changing the game in the industry.

- Where are the constraints which if you can relax, it might allow you to find a really strong competitive position?

- Avoid getting trapped or tricked by the latest trend or technological sensation.

- Focus on the underlying fundamentals.

- Analyze your competition and how it is affecting the profit.

- Learn how to approach competition in your industry.

- Identify the structure of the industry.

- Find answers to the question How is the industry changing?

- Get the tools to understand industry dynamics.

- Position your business to find that spot in the industry where you can have a really good profit.

6 Recommendations for a successful business strategy

The goal of Porter’s business framework is not to find the weaknesses of your competitors in order to drive them out of the market.

As Michael Porter says, it’s not a zero-sum game. By applying this framework, you get valuable insights which in turn can help you identify a specific and unique way in which to delight your customers.

Your business can delight your customers in one way, the competitors can delight their customers in another way.

It’s a better strategy rather than engaging in price wars which is not a long-term strategy.

When creating your strategy based on insights gained by applying Porter’s 5 Forces framework, take into account the following recommendations:

- Choose a supplier group to buy from that exercises less power over your business;

- Perform buyer selection i.e. choose a buyer group to sell to that leverages a low power over your business;

- Your business can sell to powerful buyers if it partners with a low-cost supplier or the product is unique;

- When creating your strategy, factor in the substitutes that are subject to trends improving their price-performance tradeoff with the industry’s product;

- Devise a solution to not merely survive the forces, but change them;

- Keep a close eye on industry evolution.

The key to growth—even survival—is to stake out a position that is less vulnerable to attack from head-to-head opponents, whether established or new, and less vulnerable to erosion from the direction of buyers, suppliers, and substitute goods. Establishing such a position can take many forms—solidifying relationships with favourable customers, differentiating the product either substantively or psychologically through marketing, integrating forward or backwards, establishing technological leadership.

Michael E Porter

Conclusion

Porter’s 5 Forces Framework is a very robust framework, easily applicable to all industries, allowing entrepreneurs to position the business so as to be least vulnerable to the industry’s competitive forces.

Join the Conversation

We’d love to hear what you have to say.

Get in touch with us on our LinkedIn Page, Facebook Page, Twitter or TikTok.

Source: How Competitive Forces Shape Strategy by Michael E. Porter