Blockchain Business News 1-7 March

This is the weekly wrap of blockchain business news for 1-7 March. Subscribe to get the news you need for your business!

RubiX announced full-scale NFT launchpad

RubiX is a full-scale Blockchain-as-a-Service (BaaS) and security solutions company. The company was established in 2012 and has recently migrated all of its solutions to its own open source blockchain. Read more on the BaaS market.

The BaaS company has announced the launch of its Non-Fungible Tokens (NFT) application. The application is built on the highly-scalable RubiX blockchain backed by proprietary QR Code technology that secures, authenticates and proves ownership of digital and tangible assets.

With its application, RubiX is aiming “to make NFT more accessible to our enterprise partners and general consumers.”

The RubiX blockchain is several times stronger than Bitcoin and Ethereum. Each transaction is completed within ~250ms.

RubiX NFT is a digital asset that can be applied to industries including sports merchandise and memorabilia, luxury goods, real estate and financial institutions like asset management, insurance, payments and fintech.

VTB and Gazprom Neft launched Smart Fuel, a Blockchain-Enabled Payments

VTB or Vneshtorgbank was established in 1990 in Russia to service the country’s foreign economic transactions and promote its integration into the global economy.

Gazprom Neft, a subsidiary of Gazprom, is the third largest oil producer in Russia.

Gazprom Neft’s aviation refueling business is operated by Gazprom Aero. Gazprom Aero has recently launched Smart Fuel, a revolutionary approach to aircraft refueling.

Smart Fuel is a digital payment system which allows airlines to instantly pay for the fuel directly through fully secure financial transactions in real time, 24/7.

The technology has reduced the transaction time from 4-5 days to just a few minutes, while also significantly cutting down on airlines’ costs.

AC Milan raised over $6 million with their $ACM Fan Token

Italian soccer club AC Milan has become the latest sports team to take advantage of the crypto movement.

The team has debuted with their $ACM Fan Token on Binance, the world’s biggest cryptocurrency exchange. In just a few hours, the team had raised more than $6 million in new digital revenue.

The $ACM Fan Token is on the Chiliz blockchain-based fan engagement platform Socios.com. Fan Token holders have access to a range of club benefits, including the right to vote in polls, VIP rewards, exclusive club and sponsor promotions, games, chat and ‘super-fan’ recognition.

Amazon supports Ethereum on its AWS platform

Amazon Web Services has launched an enhanced version of its Amazon Managed Blockchain service that features support for the popular Ethereum blockchain platform.

Amazon Managed Blockchain allows customers to encrypt Ethereum transaction data both at rest and while it’s traversing the network.

The service also includes tools that companies can use to continuously synchronize transaction data from their nodes with the other nodes that make up the public Ethereum main network.

Ethereum is the second blockchain platform that AWS has made available on the service. Amazon Managed Blockchain also supports Hyperledger Fabric, which is maintained by the Linux Foundation and targets the enterprise market.

Blockchain reached space

JP Morgan has successfully tested a blockchain transaction in space using Danish space firm GomSpace’s satellites.

It is the world’s first bank-led tokenised value transfer in space, executed via smart contracts on a blockchain network, established between satellites orbiting the earth.

The transaction was executed between two GOMX-4 satellites in the low Earth orbit (LEO), which validated the approach towards a decentralised network where communication with the earth is not necessary.

Hive Blockchain Sees Crypto Mining Income increase by 174%

Hive Blockchain (HIVE) is a publicly traded cryptocurrency mining firm. The firm benefited from the bull market in digital assets last quarter as bitcoin (BTC) prices rose and closed last year with $13.7 million, a 174% increase from the same period a year earlier.

The Vancouver company has a current market value of $1.57 billion after passing the $1 billion mark in early January. The lion’s share of operations are dedicated to mining Ethereum (ETH).

Crypto mining means gaining cryptocurrencies by solving cryptographic equations through the use of computers. This process involves validating data blocks and adding transaction records to a public record (ledger) known as a blockchain. Bitcoin miners receive Bitcoin as a reward for completing “blocks” of verified transactions which are added to the blockchain.

Marc Cuban is a member of the NBA’s blockchain advisory group

Marc Cuban, source: Inc. Magazine

Following the amazing success with Top Shot Moments, the NBA has established a blockchain advisory group to explore potential uses of the emerging technology.

The group includes billionaire Dallas Mavericks owner Mark Cuban, Washington Wizards owner Ted Leonsis and Brooklyn Nets owner Joseph Tsai and is tasked with determining how to leverage blockchain to benefit the NBA’s business.

JPMorgan posts 61 blockchain jobs

J.P. Morgan is one of the global leaders in financial services. S&P Global ranked JPMorgan Chase as the largest bank in the United States and the 5th largest bank in the world by total assets.

The bank has recently established a business unit solely focused on blockchain development, called Onyx, in October. Liink is J.P. Morgan’s peer-to-peer blockchain-based data network, operating under Onyx.

True to its commitment to digital currency and blockchain, the bank is now aiming to build its blockchain engineering team. The JPMorgan site is now displaying 61 open jobs for blockchain ranging from software engineers to a DevOps Engineering Lead (Vice President).

The majority of the job openings are in India, Singapore, the US and the UK.

Join the Conversation

We’d love to hear what you have to say.

Get in touch with us on our LinkedIn Page, Facebook Page, Twitter or TikTok.

Blockchain Business News 8-14 February

Stay updated with the latest blockchain news in business: subscribe to our blog notifications!

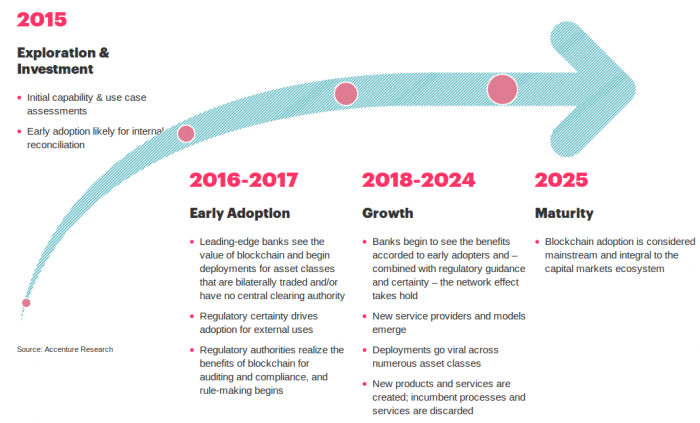

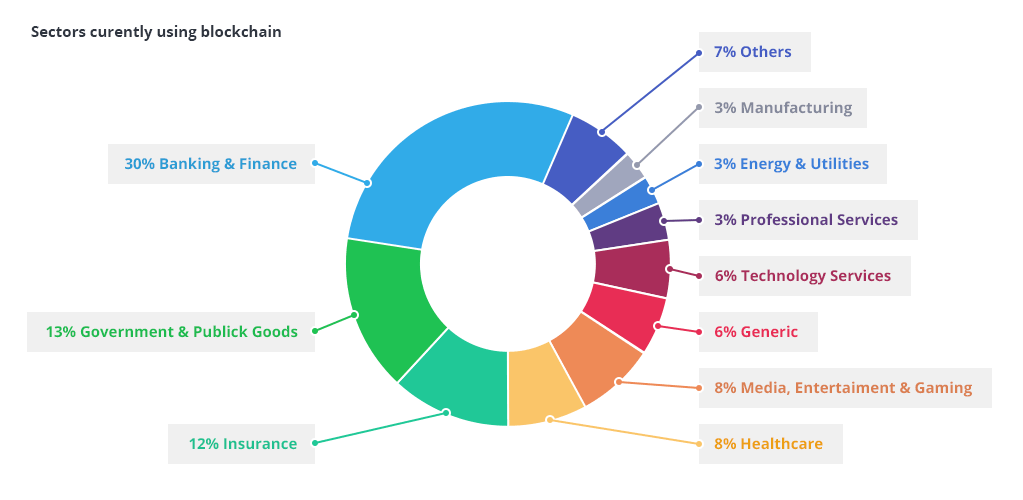

The blockchain technology market will grow at almost 63% CAGR through 2026 reaching $52.5 billion

According to ResearchAndMarkets’ latest report on blockchain, the blockchain technology market will grow at 63% by 2026 to $52.5 billion.

Important findings for the business environment:

- Distributed ledgers and other blockchain capabilities are rapidly expanding outside finance;

- The preponderance of blockchain revenue will be derived from 3 types of services: Blockchain-as-a-Service (BaaS), Cloud Computing (hosting and data as a service), and Systems Integration;

- Companies like Accenture will lead the charge for systems integration and companies like Amazon, Dell, HPE, and IBM will lead for BaaS and Cloud Computing;

- Integration and operation of Blockchain technology will redefine how various industries operate, dramatically improving efficiencies, and reduce the cost of doing business.

Blockchain fixes the ‘problem of paper’ in the bank guarantee process

In 2019, IBM and three of Australia’s finance heavyweights announced the formation of Lygon, the blockchain-based platform for bank guarantees.

Lygon is touted by the group as reducing the time to issue a bank guarantee from up to one month to one day.

The Lygon platform runs on the IBM public cloud and it leverages the IBM Blockchain Platform, which is built on top of Hyperledger Fabric, an open-source blockchain project from the Linux Foundation.

On February 9, Lygon announced minting the industry’s first standardised digital bank guarantee which solves the problem of paper.

What is the problem of paper?

Lygon CEO Justin Amos explains:

“Paper is slow, this is why we use emails; paper is expensive, and it’s estimated there are over 1 million journeys alone in Australia transporting paper guarantees. {…} Paper often gets lost and can be easily spoilt, subject to fraud, and problematic to amend.” “We shouldn’t underestimate the environmental impact of using paper,” he added.

source: dzone.com

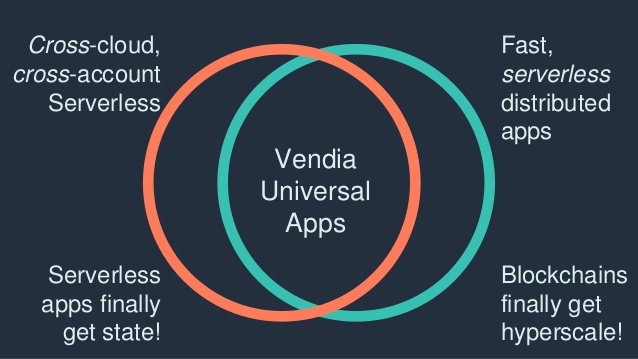

BMW backs enterprise blockchain startup Vendia in $15.5m Series A

Vendia is a multi-cloud serverless platform for sharing distributed data in real-time.

The blockchain technology startup has recently announced it had raised a $15.5 million Series A funding round for its serverless SaaS blockchain solution, bringing total funds raised to more than $20 million. One of its investors is BMW i Ventures.

BMW i Ventures is the corporate venture capital arm of BMW and has been actively investing since 2011. With an initial venture capital of 100 million dollars, BMW i Ventures invests in cutting-edge solutions focusing on BMW’s current and future business in the technology and customer & service space.

The team at BMW i Ventures manage investments in technology companies in the US, EU and Israel.

Here are some of the companies the venture capital firm has invested in:

- Verusen is AI-based inventory optimization software;

- Zendrive leverages mobile sensor data to provide actionable insights that improve safety for drivers worldwide;

- Urgent.ly is BMW’s vendor partner for roadside assistance;

- STRIVR platform utilizes immersive VR to help individuals learn faster and more effectively.

Blockchain payments Startup Celo Raises $20M

Celo is a global payments infrastructure that makes financial tools accessible to anyone with a mobile phone.

The platform is a proof-of-stake blockchain built on Ethereum, designed to support stablecoins and tokenized assets while utilizing mobile numbers to secure a user’s public keys.

According to the company’s latest press release, Celo has raised $20 million from renowned investors like a16z (Andreesen Horowitz), whose previous investments include Facebook, Slack, Asana, Lyft and more.

Since its launch in 2017, Celo developed a mainnet, a native token (CELO), a stablecoin (cUSD), a mobile payments app and has been listed on major exchanges including Coinbase and Binance.

source: techcrunch.com

Blockchain technology to be used against counterfeit products in China

Future FinTech and China Foundation of Consumer Protection have announced they signed a cooperation agreement to use blockchain technology against counterfeit products. The cooperation will expire on January 31, 2026.

Future FinTech is a leading blockchain e-commerce company and a service provider for financial technology. The company’s operations include a blockchain-based online shopping mall platform, Chain Cloud Mall, a cross-border e-commerce platform (NONOGIRL) and an incubator for blockchain-based application projects.

Cloud Chain Mall is the first C2C blockchain shopping mall operated with blockchain anti-counterfeiting tracing technology.

The goal of this agreement is to build the quality and safety credit system for Chinese brands and enterprises and protect the legitimate rights and interests of the enterprises and their brands.

source: Bologna Business School

Quote of the week

Marc Cuban / source: Inc. Magazine

It’s like the early days of the internet’ when a lot of people thought we were crazy

Investor and self-made billionaire Marc Cuban on blockchain

Join the Conversation

We’d love to hear what you have to say.

Get in touch with us on our LinkedIn Page, Facebook Page, Twitter or TikTok.