These 4 business trends are shaping 2022

4 business trends shaping 2022:

- 9-to-5 freelancing

- The rise of the “on-demand” workforce

- Making or losing money with cryptocurrencies

- NFTs for business, artists and investors

9-to-5 freelancing

We know this all too well: many businesses went into downsizing to survive the pandemic. According to World Economic Forum, the COVID-19 pandemic and the resulting lockdown caused 114 million people to lose their jobs over 2020. Experts don’t expect overall employment to return to normal until the third quarter of 2023 (source).

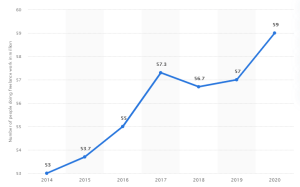

Graphic source: Siteefy

People who kept their jobs were forced to transition to working from home which came with its own set of pros and cons. Companies that didn’t adapt to this new way of working and failed to maintain employee engagement or worse, have implemented abusive employee surveillance were confronted with increasing resignation rates.

Professionals have decided that putting up with a toxic company culture on top of raising anxiety levels caused by the pandemic was simply not worth it. Some employees with small families were happy to work from home while others with different family arrangements felt that working from home was impacting their life in a negative way.

Thus the increasing number of people going into freelancing and becoming self-employed. Why work for a company that doesn’t prioritize your mental wellbeing when you can monetize your skills and experience and become your own boss?

Of course, there are specific upsides and downsides, but as the percentage in the graphic above shows, it looks like there are more advantages than disadvantages at least in this pandemic situation.

The rise of the “on-demand” workforce

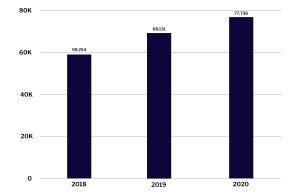

Graph source: Catalant

From Disney to Exxon to Goldman Sachs, big companies have cut jobs due to the Coronavirus. The cuts ranged from 1% to 20% of their global workforce.

Jobs still needed to get done so companies have resorted to replacing full-time employees with contract-based collaborators or freelancers.

The on-demand workforce is now in higher demand (pun intended) than in previous years. And it’s clearly a win-win situation for both workers and employers.

Hiring on-demand workers helped companies become more agile. With so many available digital platforms, it’s easier for professionals to showcase their skills and get hired project-based.

Earlier this year, a new trend within the work-from-home reality was uncovered by a Wall Street Journal report: white-collar workers working two full-time remote jobs and doubling their pay.

Making or losing money with Cryptocurrencies

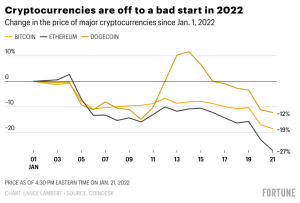

Graph source: Fortune

With people losing their jobs or getting pay cuts in the wake of the pandemic, incomes were getting thinner and thinner. For many Millennials going on the crypto market to make some money seemed like the right idea.

Prior to the outbreak of the Covid-19 pandemic, Bitcoin – the world’s first cryptocurrency – could be purchased for about $7,300. One year into the pandemic, the very same token costs more than $46,800 – a staggering 640 per cent rise (source).

At the publishing of this article, Bitcoin took another fall and is now worth $37,730. According to Binance, the total market value of all cryptocurrencies reached close to $3 trillion USD at its peak in November 2021. In Jan 2022, however, the market cap has plummeted 40%, wiping out more than $1.2 trillion USD.

Early investment in cryptocurrencies has produced several millionaires and billionaires now on Forbes’ famous list of billionaires. Others who didn’t invest early or wise, have lost large amounts of money.

NFTs for business, artists and investors

If crypto coins are the first layer of a blockchain, NFTs are the second. NFT is short for Non-Fungible Token. NFTs are digital assets that represent real-world objects like art, music, in-game items, videos and event tickets. They use blockchain technology to establish a verified and public proof of ownership.

NFTs have seen a rapid increase in awareness among artists with many selling their artworks for millions of dollars. The most expensive NFT to date is Everydays: The First 5000 Days. It was created by digital artist Mike Winkelmann (aka Beeple) and was sold for a record high of $69.3 million.

Gary Vaynerchuk, CEO of VaynerMedia and speaker at BRAND MINDS 2022 sold his NFT collection based on his doodles for $1.2 million at Christie’s auction.

The first NFT project was launched in 2015 and the interest has been growing rapidly ever since. Today the NFT market is valued at $370 billion (source: NASDAQ).

2021-2014 – NFT ideas & experiments

The idea of the NFT was implemented in 2012 on the Bitcoin blockchain. In 2014, the first NFTs were launched on Ethereum, the blockchain co-founded by Vitalik Buterin, one of the most prominent figures in the blockchain and cryptocurrency market.

2017 – the creation of Cryptokitties & CryptoPunks, cultural icons for the crypto community

The oldest and most renowned NFTs are the Cryptokitties and the Cryptopunks which were released in 2017.

CryptoKitties (source)

CryptoKitties is a blockchain game on Ethereum developed by Canadian studio Dapper Labs that allows players to purchase, collect, breed and sell virtual cats. Only 100 in number and amid the recent NFT market resurgence, the Cryptokitties began rising in value. According to DappRadar, about $7.27 million worth of CryptoKitties NFTs were transacted over a 24-hour period.

CryptoPunks (source)

CryptoPunks is a collection of 10,000 unique characters and were created by development studio Larva Labs. The characters are 24×24 pixel art images of punky-looking guys and girls, generated algorithmically. The most expensive punk is #3100 and sold for a record $7.58M. One of the latest major companies to buy a CryptoPunk is Visa, the payments technology company which paid $150,000 in Ethereum (source). To date, the lifetime total value of all CryptoPunks sales is $1.48B.

2021 – Bored Ape Yacht Club

The Bored Ape Yacht Club is a collection of 10000 unique Bored Ape NFTs— unique digital collectibles living on the Ethereum blockchain. The Bored Apes typically sell for many thousands of dollars, and some are even owned and used by celebrities as social profile pictures on Twitter. These NFT avatars are blowing up in 2021 with $750 million worth of trading volume. In September, a two-lot sale of Bored Ape NFTs brought in a combined $26.2 million at Sotheby’s.

Bored Ape Yacht Club (source)

Who invented the NFT?

No individual can claim to have invented the NFT, but we know who created the first NFT. It was artist Kevin McCoy who created Quantum, the first NFT ever created. Quantum became the first work to be associated with an NFT-type certificate of ownership in May 2014, three years before the term NFT was coined.

Looking to get more business trends?

Subscribe to our newsletter!

Blockchain Business News 22-28 February

NBA Top Shot Moments, on-court video highlights minted on the blockchain, reached $200M+ in sales

Tired of collecting the same old baseball cards? It’s time to switch to basketball!

NBA provides basketball fans with a new kind of collectables: the Top Shot Moments.

With the Top Shot Moments, fans can collect and own the NBA’s greatest highlights.

Top Shot Moments are video clips of basketball plays with animations.

These clips are licensed by the NBA and minted on the blockchain in limited supply.

Each Moment has a nonfungible token (NFT), which is unique to that specific Moment. The NFT proves the authenticity of the traded Moment, and without the need to send physical memorabilia, the transfer is very quick.

NBA Top Shot Moments is the harbinger of a new era in fandom. In just over a week, sales increased by 100%, jumping to over $200 million.

The NBA Top Shot Moments experience was created by Dapper Labs, a consumer-focused blockchain developer.

Crypto.com to perform the largest token burn in history

source: crypto.com

Crypto.com is a pioneering payment and cryptocurrency platform. Founded in 2016 with the goal of promoting the widespread adoption of cryptocurrencies, Crypto.com already has over 5 million users.

In what the company has called the largest token burn in history, 70 billion CRO will be burned as an important step to fully decentralizing the Chain network.

It will also support the company’s launch of its CRO Chain Mainnet on March 25. The burn will increase the circulating supply of CRO from the current 24% to over 80%.

We’re looking forward to joining all ecosystem partner projects and all contributors in building the world’s best infrastructure for Payments, DeFi and NFTs.

Crypto.com

Automotive Blockchain Market Size Will Grow 30% to $2 billion by 2026

In 2019, the global Automotive Blockchain Market was approximately $300 Million.

The latest study reports that the market is expected to grow at a CAGR of 30% and is anticipated to reach around $2 billion by 2026.

Top market players are Ripple Labs Inc., Ethereum, Bigchaindb, Carblock, Consensys, Shiftmobility, IBM, Context Labs, Cube, Accenture and others.

What is the application of blockchain technology in the automotive market?

Blockchain technology in the automotive sector can be used to store and update information related to vehicle spare parts.

This helps the car manufacturer, service providers, and customers to track the origin of the part avoiding the selection of counterfeited products.

NFTs based on the show American Gods to roll out in the coming days

American Gods is a fantasy drama series based on Neil Gaiman’s novel of the same name. The show, now in its third season, is very popular, having won several prestigious TV awards to date.

Last week, Fremantle, the show’s producer, announced that they would roll out American Gods digital collectables, i.e. NFTs, in collaboration with Curio, a platform that allows fans to own, share or trade digital items in a manner akin to physical trading cards or collectables.

A spokesperson for Fremantle said the digital collectables are a new way for the show’s fans to “share and interact in a deeper and more meaningful way with the content and characters they love.”

State Bank Of India Joins Liink, JPMorgan’s Blockchain Network

J.P. Morgan is one of the global leaders in financial services. S&P Global ranked JPMorgan Chase as the largest bank in the United States and the 5th largest bank in the world by total assets.

Recently, J.P. Morgan has been increasing its commitment and interest in digital currency and blockchain. The bank established a business unit solely focused on blockchain development, called Onyx, in October. Liink is J.P. Morgan’s peer-to-peer blockchain-based data network, operating under Onyx.

Using Liink helps lower transaction costs and reduce the time taken to resolve cross-border payments-related inquiries from up to a fortnight to a few hours.

About 100 banks are live on the network now with State Bank of India being the latest to join Liink.

A research report from Bank of America found that 21% of banks they cover have incorporated blockchain technology into their businesses in some form.

Modulus introduces Blockchain-as-a-Service offering

Modulus is a US-based developer of ultra-high-performance trading and surveillance technology that powers global equities, derivatives, and digital asset exchanges.

Last week, the company announced that it released a Blockchain-as-a-Service offering.

What is Blockchain-as-a-Service?

Blockchain as a Service (BaaS) is a type of blockchain service offering that allows business customers to use cloud-based solutions to develop, host and adopt their own blockchain applications, smart contracts and other relevant functions on the blockchain.

The BaaS market is on the rise.

According to the latest reports, the global blockchain-as-a-service market size is set to reach $24.94 billion by 2027, exhibiting an impressive CAGR of 39.5% during the forecast period.

Huawei, Baidu, Oracle, IBM, Alibaba are among the key companies operating in the BaaS market.

Modulus’ BaaS offering is blending a mix of image recognition and other types of bio-inspired AI together with blockchain technology.

“Our solution can verify that a distinct event happened at an exact time, by a specific person in a particular location. It really is next-generation verification in every sense of the concept,” explained Richard Gardner, CEO of Modulus.

Quote of the week

Peter Thiel (thielfoundation.org)

PayPal had these goals of creating a new currency. We failed at that, and we just created a new payment system. I think Bitcoin has succeeded on the level of a new currency, but the payment system is somewhat lacking. It’s very hard to use, and that’s the big challenge on the Bitcoin side.

Peter Thiel, Co-Founder of PayPal (source)

Join the Conversation

We’d love to hear what you have to say.

Get in touch with us on our LinkedIn Page, Facebook Page, Twitter or TikTok.