The UK’s new 2022 tech unicorns

The UK continues to be the #1 tech hub in Europe, in 2022, home to 131 tech unicorns and 228 future tech unicorns to date.

Recent reports estimate a $1 trillion valuation for the U.K.’s startup and scaleup ecosystem, with fintech leading the way as the industry attracts the most money from VCs.

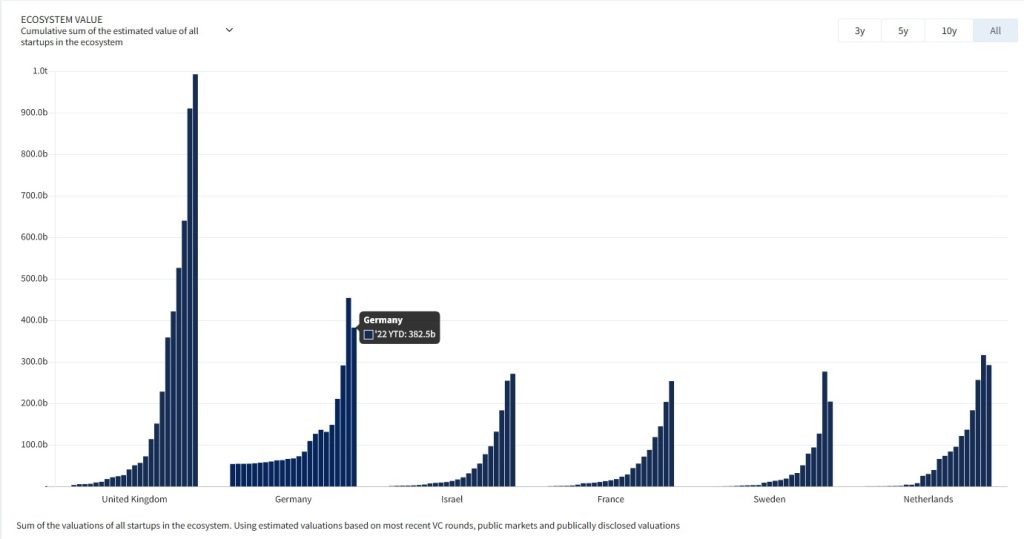

Tech ecosystem value in European countries

(source Dealroom)

THE UK’S TECH ECOSYSTEM – STATISTICS (source: Dealroom)

- Top 3 industries by value: Fintech (48.1 billion US dollars), Health (28.6 billion US dollars), Enterprise Software (20.1 billion US dollars)

- 607.000 employees

- 133.6 billion US dollars in VC funding since 2015

- 15.000 funding rounds since 2015

- 40.000 startups

- 23.000 startups founded in the last 10 years

THE UK’S NEW 2022 TECH UNICORNS

5ire – The world’s first sustainable blockchain

Current valuation: 1.5 billion US dollars

Total funding: 121 million US dollars

5ire investors: SRAM & MRAM Group, Oracle Investment Management, Alphabit Fund, Marshland Capital, Moonrock Capital, Launchpool, Magnus Capital, Sanctum Global Ventures

Tech startup 5ire is just one year old and already a unicorn! Its co-founders are Pratik Gauri, Prateek Dwivedi and Vilma Mattila.

In a recent interview, 5ire CEO Pratik Gauri said that their primary goal starting out was to “impact a billion people positively.”

How are they going to achieve that?

By building a scalable decentralized, open-source blockchain for Impact & SDG-related development, to help accelerate the United Nations 2030 Agenda for Sustainable Development.

“Our goal is to work hard to provide finance platforms that could potentially revolutionize access to capital and unlock potential for new investors in projects that address environmental challenges”, says the 5ire team.

What is 5ire’s current challenge and what is the company doing to overcome it?

Here’s what 5ire co-founder & CEO Pratik Gauri answered:

Founder & CEO Pratik Gauri

Human Capital is a big challenge in the web3 / blockchain space. Since we are using rust to develop a sustainable blockchain with a unique consensus called Proof Of Benefit, it’s been a challenge to find rust developers.

To overcome this, we’ve started a 5ire digital university to train developers on rust/substrate and hire them in-house.

Multiverse – The UK’s first-ever EdTech unicorn

Current valuation: 1.7 billion US dollars

Total funding: 414 million US dollars

Multiverse investors: Lightspeed Venture Partners, Index Ventures, Salesforce Ventures, General Catalyst Partners, D1 Capital Partners and others.

Tech unicorn Multiverse provides high-quality apprenticeship programmes that combine work, training and community. Its mission is to create a diverse group of future leaders; its focus is on developing new skills and competencies for the digital economy.

Multiverse was founded by Euan Blair in 2016 and has grown across the UK, training over 5,000 apprentices in partnership with more than 200 of the world’s best employers.

Multiverse helped many industry leaders close the skills gaps within their workforce and grow retention including global leader in financial services Morgan Stanley, Big Four accounting organization KPMG and Global Investment Bank and Financial Services Citi.

In June 2022, the EdTech unicorn announced the closing of $220m Series D funding and highlighted the following great results:

- Its software engineering program has seen a 260% increase in enrolments while maintaining a completion rate of 85%;

- The number of partners has grown by 105%;

- Since 2020, Multiverse has grown 9x in size;

- The company now trains professional apprentices with over 500 organizations globally, including Verizon, Cisco, Visa and others;

- Of the apprentices they have placed, 56% are people of color, more than half are women, and 34% hail from economically underserved communities;

- 68% of their apprentices are promoted either during their program or at its conclusion;

- 90% find permanent employment, either at their employer or within their industry.

Paddle – The complete payments infrastructure provider for SaaS companies

Current valuation: 1.4 billion US dollars

Total funding: 291 million US dollars

Paddle investors: Silicon Valley Bank, Notion Capital, Kindred Capital, Business Growth Fund, 83North and others.

Paddle offers an all-in-one payment solution to SaaS companies looking to permanently offload the burden of managing payments and the associated liabilities.

The tech unicorn is a software expert providing SaaS businesses with Merchant of record (MoR) services allowing them to grow more quickly (learn about MoR).

Founded in 2012 by Christian Owens and Harrison Rose, Paddle has over 3000 customers and 350 employees in 17 countries. The tech unicorn has marked its ten-year anniversary with the acquisition of ProfitWell, the leading provider of subscription metrics and retention software.

Entering the second decade of its existence, curious minds might ask: Does it get any easier?

Paddle CEO Christian Owens answers: “It doesn’t get easier, the problems just change”.

Forterro – Group of ERP software and services companies serving small to midmarket companies around the globe

Current valuation: 1.1 billion US dollars

Total funding: N/A (Battery Ventures acquired Forterro for 1b euros in 2022)

Forterro investors: Battery Ventures

With a European portfolio of specialised ERP (enterprise resource planning) software products and a global ecosystem of IT solutions and services, Forterro is a partner to more than 10,000 midmarket manufacturing and production companies.

Forterro operates product companies headquartered in Germany, France, Sweden, Switzerland, Poland, and the UK, as well as regional service hubs and development centers around the world.

In July 2022, Forterro announced the acquisition of Wise Software, a provider of ERP software solutions for industrial companies with retail, wholesale, eCommerce, and distribution requirements with 30 years in the UK market.

Payhawk – Credit cards, payments, expenses and cash combined into one integrated platform

Current valuation: 1 billion US dollars

Total funding: 236 million US dollars

Payhawk investors: Greenoaks Capital Partners, Lightspeed Venture Partners, Endeavor Catalyst, HubSpot Ventures, Earlybird Digital East Fund and others.

Fintech Payhawk offers all-in-one financial software to control company spending and save money. A report from the tech unicorn shows that scale-ups typically save up to 8,417 euros/month, SMBs, 1,015 euros and enterprises, 20,792 euros.

With Payhawk, small businesses manage, control and automate tedious administrative tasks, scale-ups keep spending under control and are encouraged and supported to undertake international expansion in more than 30 countries and enterprises transition to a paperless digital environment.

The UK fintech unicorn was founded in 2018 by Hristo Borisov, Konstantin Djengozov and Boyko Karadzhov. Their aspiration is “to become the world’s biggest bank without holding a single dollar”.

Their vision of the future is a world where “businesses can discover, manage and use multiple payment instruments (debit cards, credit cards, bank account etc.) powered by a single experience regardless of where money is kept.”

Tripledot Studios – Independent mobile game developer

Current valuation: 1.4 billion US dollars

Total funding: 202 million US dollars

Tripledot Studios investors: Velo Partners, Eldridge, Access Industries, The Twenty Minute VC (20VC) and Lightspeed Venture Partners.

Tripledot Studios is a fast-growing studio, led by a team of industry veterans from some of the biggest names in mobile games.

The tech unicorn was founded in 2017 by Akin Babayigit, Eyal Chameides and Lior Shiff. Their goal is to create fun, successful games for everyday gamers. The team’s guiding belief is that “when we love what we do, what we do will be loved by others. Together, we create games we know our players will enjoy, from easy-to-pick-up casual games to groundbreaking innovative ones.”

In a profile article in Forbes, the team shared that the company did $200 million in revenue last year on an estimated profit of around $30 million with over 30 million monthly users enjoying their games. Tripledot’s biggest hit is Woodoku, a combination of Tetris and sudoku. It launched in 2020 and has since been downloaded 100 million times.

I asked Tripledot Studios COO Akin Babayigit what is the company’s biggest challenge today and what is the team doing to address it.

Co-Founder & COO Akin Babayigit

Tripledot has been very fortunate to be growing leaps and bounds over the past few years, in an industry as highly competitive as mobile gaming.

As a growing organisation, our biggest challenge is to continue hiring the best & the brightest minds to become Tripledotters.

We saw in our previous experiences that growing organisations may tend to lower the quality bar for new hires as the pressures of growing become more pronounced. We don’t want to sacrifice our track record of hiring the best and the brightest minds, so our hiring bar remains exceptionally high. That probably is our biggest challenge at the moment.

Accelerant – Insurtech Unicorn with an Excellent (A) credit rating

Current valuation: 2 billion US dollars

Total funding: 190 million US dollars

Accelerant investors: MS&AD Ventures, Altamont Capital Partners and Eldridge.

Accelerant is a data-driven, technology-fueled insurtech that empowers underwriters with superior risk exchange, advanced data analytics, and long-term capacity commitments.

The company’s technology platform, InsightFull™, allows customers to spot small issues early before they become big problems.

Accelerant was founded by insurance industry veterans Jeff Radke and Chris Lee-Smith. They are joined by a team of professionals who understand the challenges of dealing with conventional carriers. Accelerant is Property and Casualty focused with a portfolio containing Hospitality, Arts & Entertainment, InsurTech, Habitational, Construction, Retail, Mercantile, Service, Trade, Surety and Warranty.

Ceres Power Holdings – World-leading developer of low-cost, next-generation fuel cell technology that creates a real-world energy solution

Current valuation: 1.2 billion US dollars

Total funding: 252 million US dollars (per Crunchbase)

Ceres Power Holdings investors: University of Bristol Enterprise Fund, Imperial College London, Parkwalk Advisors, Advanced Propulsion Centre UK, Investec and Berenberg (Germany).

Ceres Power Holdings is a clean tech unicorn, one of the leading developers of fuel cell technology in the UK. With 21 years of experience developing green technology, the company’s ultimate purpose is to help sustain a clean, green planet by ensuring there is clean energy everywhere in the world.

In recent news, Ceres has partnered with Shell to deliver a megawatt-scale electrolyser demonstrator for the production of low-cost, high-efficiency green hydrogen.

Ceres’ solid oxide fuel cell (SOFC) technology shows an essential role in significantly reducing CO2 emissions.

Smart Metering Systems – Provider of multi-utility infrastructure connections and meter asset management solutions

Current valuation: 1.6 billion US dollars

Total funding: N/A

Smart Metering Systems investors: N/A

Smart Metering Systems is working closely with private and public sector partners to decarbonise the UK economy by 2050.

They are a fully integrated energy infrastructure company which owns, installs, and manages carbon reduction (CaRe) assets, including smart meters, battery energy storage systems (BESS), and EV chargepoints.

Smart Metering Systems use its technology expertise, asset funding capability, and deep engineering skills to provide sustainable energy solutions for customers.

Net neutrality 2018 – where does it go?

The U.S. Federal Communications Commission voted along party lines on Thursday to repeal landmark 2015 rules aimed at ensuring a free and open internet, setting up a court fight over a move that could recast the digital landscape, reported Reuters.

“The approval of FCC Chairman Ajit Pai’s proposal in a 3-2 vote marked a victory for internet service providers such as AT&T Inc, Comcast Corp and Verizon Communications Inc and hands them power over what content consumers can access. It also is the biggest win for Pai in his sweeping effort to undo many telecommunications regulations since taking over at the agency in January. Democrats, Hollywood and companies such as Google parent Alphabet Inc and Facebook Inc had urged Pai, a Republican appointed by U.S. President Donald Trump, to keep the Obama-era rules barring service providers from blocking, slowing access to or charging more for certain content. The new rules give internet service providers sweeping powers to change how consumers access the internet but must have new transparency requirements that will require them to disclose any changes to consumers,” commented David Shepardon for Reuters.

What can this mean in the near future? Even the consumers will probably don’t see immediate changes, it is reported that smaller startups worry the lack of restrictions could drive up costs or lead to their content being blocked.

This vote will negatively impact small- and medium-sized Internet business, and has the potential to decrease jobs and economic growth system-wide,” said Christian Dawson, executive director of i2Coalition, which includes Amazon and Google, quoted by USA Today.

“The scrapping of the Obama administration’s rules is likely to set up a court battle and could redraw the digital landscape, with internet service providers possibly revising how Americans view online content. The providers could use new authority to limit or slow some websites or offer “fast lanes” for certain content. Republicans on the FCC have sought to reassure young people that their ability to access the internet will not change after the rules take effect. People who favor the move argue that after users realize that little or nothing has changed in their internet access, it will not resonate as a political issue,” writes Fortune.

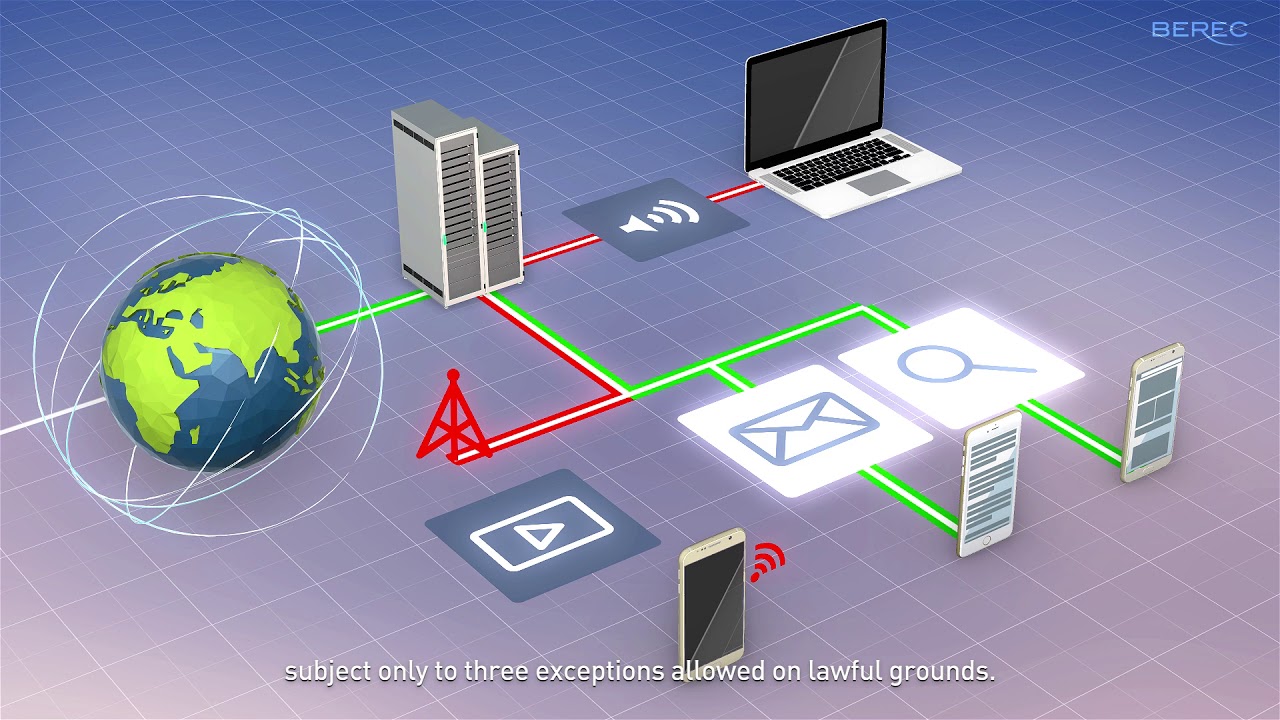

Meanwhile, in Europe….

According to Conversation, in the UK, “net neutrality is currently protected by EU policy 2015-2120 in support of a Digital Single Market – Brexit fallout aside. Potentially, after Brexit, the UK government could choose to revoke this policy, although this is unlikely because it has already committed to a Universal Service Obligation (USO), effectively making broadband access a legal requirement, as it has been in Finland for many years. Additionally, ISPs are held to account by the UK communications regulator OFCOM, which is tasked with ensuring fair play and protecting consumers from poor service. There has been widespread criticism that OFCOM has been slow and ineffective in persuading big players such as BT/Openreach to act responsibly in the past, though it has made progress recently.”

Online versus offline retail war ending soon?

“2018 will mark death of online versus offline retail war”, said Mariam Asmar, McCann London’s strategy and innovation director, for Campaign UK.

What is for certain is that both worlds willcontinue for sure to exists for a good while. In a demanding night and day economy, consumers want access to shopping at all times. They want to use price comparison sites, they want infinite choice in styles and sizes and they want to do it all from the comfort of their own home without the pressure of three different sales assistants hanging around waiting to bag some commission.

At the same time, “physical brick and mortar stores will continue to have a place in a world that still requires, and desires, human connection. The current statistic is that 90% of purchases in the UK are still made in store, while 60% of Generation Z consumers value the store experience. Millennials even want to shop in places they can touch, feel and see their product. Not to mention for some, shopping is an experience and they appreciate input and care from the staff and in store experiences,” wrote liveandbreathe.com.

Last year, in the USA, according to “The Atlantic”, online shopping was having an offline moment, as more e-commerce companies, such as RentTheRunway and Bonobos, invested in the physical stores they once made seem obsolete. Leading the trend is Amazon, the undisputed king of online shopping, which spent $14 billion to buy Whole Foods and its nearly 500 physical locations. “According to internal documents, the company believes there is support for another 2,000 Amazon Fresh–branded grocery stores. This throwback revolution is happening in the midst of what otherwise feels like a “retail apocalypse.” Bankruptcies are rising among clothing chains, like Wet Seal, and retail icons, like Toys “R” Us, which are stuck with a glut of shopping space and squeezed between stagnating sales and large debt obligations,” wrote “The Atlantic”.

While Amazon did make a bigger splash with its $13.7 billion investment, Walmart beefed up an e-commerce stable that already includes the acquisitions of digital natives Jet.com, Shoebuy, ModCloth and Moosejaw. Collectively, these M&A deals have set Amazon, the world’s largest e-commerce company, on a direct collision with Walmart, the world’s largest retailer, to be the “everything store” in an omni-channel world — where consumers no longer distinguish between shopping online and offline.

In the future, Amazon could upgrade Whole Foods with innovative retail technologies in use at its fully automated experimental store, Amazon Go, where shoppers pick up their food and leave. There are no cashiers or checkout lines. Amazon tracks what’s taken, or put back, and charges their accounts.

Moreover, “several brick-and-mortar companies with large footprints are struggling while e-commerce companies that once launched pop-ups as mere marketing tools have realized the value of storefronts,”considers The Atlantic. For instance Amazon sees a growth in online shopping in regions where it’s opened a physical store, according to CNBC. “Five years from now, we won’t be debating whether ‘e-tailers’ are taking share from ‘brick & mortar retailers,’” Citi Research analysts recently wrote, “because they are all the same.” The trend even comes with an inevitable, and regrettable, catchphrase: “bricks and clicks.”

“Among the nation’s top 300 malls, brick-and-mortar space occupied by retailers that started online has grown by approximately 1,000 percent since 2012, according to the real-estate data company CoStar Group. While they currently account for a minuscule part of mall volume, landlords increasingly consider them critical to attracting Millennials to these malls in the first place,” adds “The Atlantic”.

In India, another big and important country, according to blog.markgrowth.com, “the FMCG is vertical: 90% of sales happen via mom and pop stores (Kirana) which are plenty in number. The remaining 10% of sales is accounted for by Modern Trade outlets ( Large Retail format stores similar to Walmart ) and the online channel. Now, these mom and pop stores are not going to go anywhere ( Over 10 million outlets in every nook and corner of the country!). Technology will aid these stores in the near future which will arm retailers with data regarding consumption patterns for instance, which will prevent stock-outs leading to an enhanced experience on the whole.”

More about the e-commerce in India and the classic retail industry one can read here and here.

Meanwhile, in China, according to www.scmp.com, malls are starting their own digital stores as they hitch their bandwagon to the concept of “new retail” pioneered by the Alibaba Holding Group chairman, Jack Ma Yun. The “online-offline integrated experience” is increasingly being used by Chinese retail property operators, who see it as a critical way of gaining insight into consumers’ shopping patterns and responding to these quickly.

The digital out-of-home advertising is already blooming

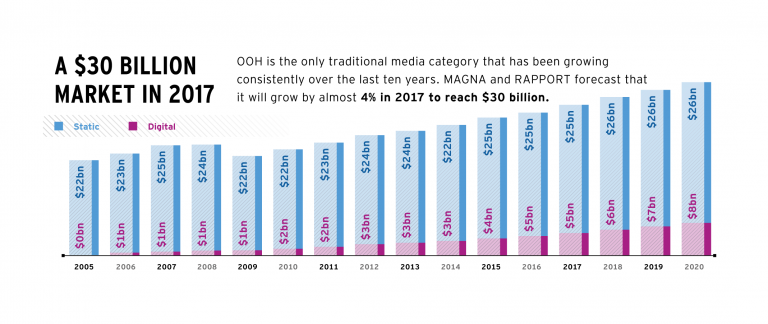

The share of global advertising spend going to out-of-home (OOH) advertising remains stable at 6 percent, shows ‘Why Out Of Home Performs’, a joint study by Magna Intelligence and Rapport, IPG Mediabrand’s out-of-home agency, into OOH’s continued growth and impact. The report was based on findings from an analysis of the global OOH industry and OOH advertising in 70 countries. This is largely down to major investment in digital OOH (or DOOH), which is growing in every environment and has seen unit numbers jump 70,000 to 300,000 worldwide in two years, and revenue increase by 30 percent.

Digital OOH is boosting advertising revenues by creating more opportunities for marketers in premium locations like airports or malls, thus increasing the revenue per panel multiple times. Although digital units account for only 5% of the global OOH inventory, they already generate 14% of total advertising revenues. In fact, DOOH already accounts for 30% of revenues in some markets like the UK and Australia, and the global share is predicted to grow to 24% globally by 2021.

“With the explosive growth of digital-out-of-home (DOOH), the diversified lifestyle touch points it reaches, and the veritable mountain of mobile driven audience data, we are best positioned to accurately, and in real-time, track audiences and deliver contextually relevant messages through out-of-home media. OOH’s sustained growth on a global scale will further enable us to create engaging consumer experiences,” said Mike Cooper, Global CEO Rapport.

source: Campaign Asia

“The digital-out-of-home market is a return to advertising’s roots, quietly shifting the industry by way of re-imagining the classic advertising experience. Nearly $4.5 billion is expected to be spent on DOOH advertising in the U.S. by 2019, an increase of approximately $1.2 billion from 2016. Zenith forecasts that DOOH will grow faster globally than all other buying methods, and PricewaterhouseCoopers predicts that DOOH advertising revenues will overtake traditional media spend in 2020, growing at a rate of 15% a year for the next four years,” writes AdAge.com.

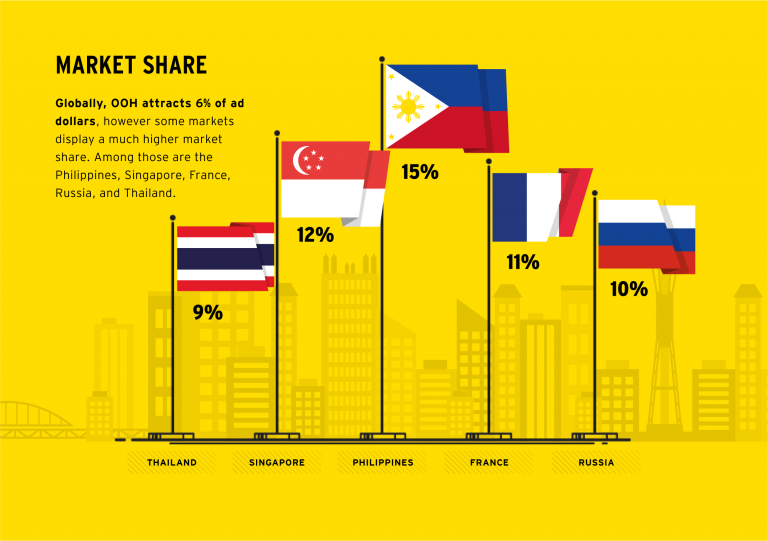

According to MAGNA, OOH advertising is now a $29 billion market, responsible for approximately 6% of the $500 billion global advertising spending. However, OOH market share increases to 10% to 12% in some countries, including France and Russia, compared with other media categories including Internet, TV, print and radio. OOH market share has remained stable in the last five years, hovering around 6%. However, as part of its increasing importance in the media mix, OOH market share has increased from 8% to 10% of traditional media advertising spend, which includes TV, print, radio and out-of-home, among other categories.

MAGNA Intelligence, in partnership with Rapport, conducted an in-depth survey in 22 key markets including Argentina, Australia, Belgium, Canada, China, Denmark, France, Germany, India, Italy, Japan, Malaysia, Mexico, Netherlands, Norway, Philippines, Russia, Singapore, Spain, Thailand, United Kingdom and the United States. The objective of the survey was to assess OOH advertising’s sustained growth and impact during a period where offline marketing budgets are stagnating and other media categories are struggling.

Moreover, MAGNA showed in another study launched in June, that in the USA, Out-of-Home (OOH) advertising is expected to grow +2% to $7.9 billion in 2017, including cinema. MAGNA reduces its 2017 growth forecast following weak first quarter advertising sales, which grew by just +0.3% in a sudden slowdown, as seven of the last eight quarters had shown year-over-year growth of +3% or more. The 1Q17 stagnation occurred as a result of several key verticals reducing spend, including both automotive and food & beverage, which both experienced double-digit declines. This offset the continued growth from tech brands (e.g. Google, Apple, Hulu and Netflix) that have driven OOH sales over the last two years.

The DOOH market encapsulates everything from digital billboards to screens in elevators to screens on jukeboxes. Unlike internet or mobile advertising, it allows advertisers to reach target audiences in a specific, real-world context. Instead of interrupting an internet user’s online experience with an ad, it’s focused on marketing to consumers when they are “on the go” in public places or in transit. Due to its specifications, the technology has the opportunity to give to its target the message in a format that’s automated, dynamic and interactive.

“The DOOH space presents a major opportunity for creatives, technologists and consumers alike. We see DOOH’s effectiveness in the numbers: the 2016 Nielsen OOH ad study found 91% of U.S. residents age 16 or older, who have traveled in a vehicle in the past month, noticed some form of OOH, and 79% noticed OOH in the past week. The same Nielsen digital billboards study found 71% of digital billboard viewers find those ads to stand out more than online ads. Ultimately, the emerging digital-out-of-home market is groundbreaking in its interactive technology, but it’s also a return to advertising’s roots and the original purpose around advertising: to provide an engaging and useful service to the public,” writes AdAge.

Globally, in 2016, the OOH market was worth $28 billion in net advertising, according to Magna’s report, and is predicted to grow by 4 percent per year to reach $33 billion by 2021. Behind this growth is an ever-more concentrated supply-side market, in which the top international OOH media owners are continuing to expand their influence: the six main global vendors (in order of 2016 revenue size, JCDecaux, Clear Channel, Outfront, Lamar, Stroer and Exterior) now control almost 40 percent of the whole market. By 2021, the report predicts small, but significant changes, in the environments most used for OOH. Use of billboards, currently the top revenue-generating segment and performing particularly well in India, Russia and the US, will drop 4 percent from 45 to 41 in the next five years. Street furniture and transit, meanwhile, are due to grow, respectively, from 31 to 34 percent and from 14 to 15 percent as local authorities become more willing to partner with OOH vendors. A series of major contracts—typically over 10 years long—in big cities are also in the process of renewal, the first time this has happened in the era of DOOH and programmatic opportunities, which partly explains DOOH’s recent giant revenue leap.

According to APAC, while the US is the largest OOH market, valued at $7.1 billion last year, APAC countries Japan ($4.7 billion) and China ($3.1 billion) come in at second and third position and per capita spending on OOH amounts to a record $38 per year in Japan, compared to $22 in the US. Singapore spends the second highest amount per capita at $36 a year. In the Philippines, meanwhile, OOH accounts for one of the highest percentage shares of overall ad spend in the world, at 15 percent compared to the global share of 6 percent. Singapore (12 percent) and Thailand (9 percent) also exceed the worldwide average.

Singapore’s OOH ads have the highest reach range of any other APAC market, with a penetration of 70 to 80 percent of the relevant population, due to its concentrated levels of urbanisation. Australia’s have the second highest, reaching 60 to 70 percent, but neither matches the reach of OOH ads in Argentina, which are considered seen by a huge 85 to 95 percent of the population.

In Australia, DOOH represents more than a third of total OOH spend, which the report attributes to a sophisticated advertising market and a population relatively concentrated in a few urban centers.

In China, the total OOH spend about matches other markets, it is one of the top five global markets in terms of penetration of digital, led by the transit segment. By 2021, MAGNA predicts that digital growth will have doubled, while OOH growth will be stagnating, partly due to lack of interest in non-digital inventory.

“OOH’s natural convergence with other digital media has hurt most other ad forms. OOH complements digital media by amplifying and enhancing it. This phenomenon has brought additional ad revenue to OOH, while most other media have experienced revenue losses as a result of the growth in digital.OOH has benefited from other new technologies, too, such as social media and mobile. Many OOH media campaigns are now picked up on social media, which greatly amplifies the total viewership. When consumers are on mobile devices, OOH is typically one of the last ad forms they’re exposed to just before important path-to-purchase decisions,” explained Steve Nicklin, Vice President of Marketing, OAAA, for billboardinsider.com.

The innovative opportunities provided by the digital platform have provided the OOH industry with new thinking and new ideas. Moreover, in the USA, as shown by the USA Touchpoints/RealityMine study, OOH and Today’s Mobile Consumer, consumers spend more time with OOH than any other form of advertising media except TV. The findings are supported by the 2016 Nielsen OOH ad study that found that 91% of US residents age 16 or older, who have traveled in a vehicle in the past month, noticed some form of OOH, and 79% have noticed OOH in the past week. Their research also discovered impressive levels of engagement, with 82% of billboard viewers reporting they look at the advertising message at least some of the time; and over one-third looking at the billboard ad each time or almost each time they noticed one. The Nielsen digital billboards study found 71% of digital billboard viewers find them to stand out more than online ads.

OOH is expanding to brand new environments. Digital screens have allowed OOH advertising vendors to penetration niche environment allowing to reach young urban population that is otherwise hard to reach by traditional media: offices, elevators, taxi, gyms, bars, retail etc. The “Digital Place-Based” segment offers targeting capabilities and programmatic opportunities. Moreover, OOH becomes addressable and experiments with programmatic. Initially developed to automate the trading of online display ads, the programmatic technologies are now being used in to buy and optimize ad campaigns on connected DOOH units.

Programmatic techniques not only optimize the workflow of media-buying but help brands deliver the right ad in the right place and at the right time, using consumer data and mobile location data. Giving advertisers the ability to plan, buy, optimize and measure the effectiveness of their outdoor campaigns through an online platform represents the natural evolution of OOH’s technology-driven transformation with many vendors developing Private Marketplaces (PMP).

Besides that, DOOH is going social. “There are two main avenues DOOH is being used to complement social campaigns, either through integration or through content creation,” says Neil Morris, founder and CEO of UK-based creative production house Grand Visual.

Mobile advertising to pass the $100 billion mark for the first time

Digital media has now surpassed linear television to become the No.1 category in advertising revenues. Within digital, the majority of advertising sales (54%) is now generated by impressions and clicks on mobile devices. The data are gathered from Magna Advertising’s Spring Forecast, June 2017. Globally, media owners advertising revenues are projected to grow by +3.7% in 2017, to $504 billion. This is a noticeable drop compared to 2016 which displayed a record +5.9% growth rate. Global advertising growth is expected to re-accelerate to +4.5% in 2018, with the return of even-year events (Football World Cup in Russia, Mid-Term U.S. elections, Winter Olympics in South Korea).

Online advertising sales will grow by 14% this year while offline ad sales (television, print, radio, out-of-home) will decrease by -2% (last year was flat), but it will pass the $200 billion mark ($204 billion) to become the #1 category globally, with 40% of total ad sales vs 36% for television. Within digital, the majority of advertising sales (54%) is now generated by impressions and clicks on mobile devices.

The star of these years, the mobile advertising will be passing the $100 billion mark for the first time this year ($110bn), while the video and social formats will continue to drive digital advertising growth (+30% or more) with paid search growing double digits again (+13%) to remain the number one format (almost half of digital ad sales). The two digital-native advertising formats or environments (search and social) now represent a combined 70% of total digital ad spend and will capture 85% of the net growth this year. For the second year in a row, social video formats (counted as “social” by MAGNA) will represent a major driver to digital spend, attracting major consumer brands in the social environment where, until recently, there was not significant spend in this category.

While this is slower than last year’s 51.6% mobile growth rate, it represents $27 billion of incremental mobile advertising spend, which is in line with last year’s $28 billion of incremental mobile spend. Mobile isn’t losing any momentum; growth rates are only declining because of the increasing base of mobile advertising spend. This strong growth contrasts with desktop growth, which is expected to shrink by -2.2% this year. This is the second consecutive year of negative desktop advertising growth, and it is expected to continue to decline for the foreseeable future. Within digital, search advertising is by far the largest portion of spend; search is expected to grow by 13% this year to reach $99 billion, or just under half of total digital advertising budgets. This growth represents 30% mobile search growth, and desktop search shrinking by -3%. Mobile search advertising has passed the halfway point to become the majority of search advertising spend, with 55% total share expected this year. Furthermore, the incremental $11 billion of search advertising spend represents over 40% of total incremental digital dollars. Search has been especially strong because of both continued new product innovations such as search re-marketing and customer match lists, along with the growth of non-core search such as Alibaba product listings. Furthermore, search advertising continues to be strong because of its position in the advertising funnel and the ease with which search activity can be connected to customer behavior and sales. Looking forward, search advertising will remain robust, growing around 10% annually to reach $140 billion by 2021. At that point, it will be larger than newspaper, magazines, radio, and OOH combined.

Equally important within digital advertising is social media, which is expected to grow by +32% this year to reach $42 billion, slightly ahead of prior expectations for +29% growth. Social advertising is the fastest growing portion of digital spend, and like search, this is because of mobile platforms. 85% of total social advertising dollars are coming from mobile devices, the highest share of any digital sub-format. Furthermore, social’s 31.6% growth rate represents $10 billion of incremental spend. This is nearly as much as can be found in search advertising despite social being less than half the total size. Growth comes both 10/17 from increased social usage and penetration, as well as new product innovations, including social video, and increasingly dense ad loads on social media. Looking forward, mobile advertising will continue to be dominant in social: by 2021 it will represent 93% of total social media sales. Impressively, search and social combine to represent more than the total of incremental dollars across all media formats (offline media and shrinking digital formats like banner display are net losers; search and social are the growth engine for global ad spend). Video advertising is growing nearly as quickly as social media; growth this year is expected to be 30%, which will bring total video advertising spend to $23 billion. While desktop video is still showing growth at +14% (unlike most other desktop formats), the engine for online video ad spend growth is mobile (+56% growth expected to bring mobile share of video spend to +45% this year). Mobile video will match desktop next year as the mobile video experience, wireless broadband penetration, and mobile video content continues to improve. By 2021, online video advertising will have passed the $50 billion mark globally, and digital video will represent more than 20% of total video viewing (TV and online video). Banner display and other digital advertising formats (email advertising, online classifieds etc.) are stagnating, with both expected to shrink by around -3% this year. Not only have brands found better outcomes using other digital formats such as search, social, and video, but display inventory is also on the decline. Standard banner online real estate is being replaced by video and other rich media formats.

“The record level of growth in 2016 globally, outperforming economic growth, was caused by marketers willing to embrace the new opportunities offered by digital media (search, social, video, programmatic) on a larger scale, while anxious to preserve their share of voice on traditional linear television, despite rising CPMs costs. In 2017, both digital and offline growth will slow down. Online advertising sales will nevertheless continue to grow by double-digits in most markets (globally +13%), but television ad sales will decline (-1%) due to softer price increases, ratings erosion and the lack of global sports events,” declared Vincent Létang, EVP, Global Market Intelligence at MAGNA and author of the report.

In the UK, online advertising sales will grow by an average 10% through the region, to $42 billion. Digital advertising now represents almost 42% of total advertising in Western Europe, slightly above the global average (40%). The fastest-growing formats will be social media (+37%) and video (+19%) while paid search spending will grow by 10%. Ad revenues from static banners will decrease by 5%. In terms of platform, mobile will capture all the growth (+36% to $19 billion). Mobile ad sales will represent 43% of internet ad sales by the end of 2017, which is slightly below the global average or APAC average.

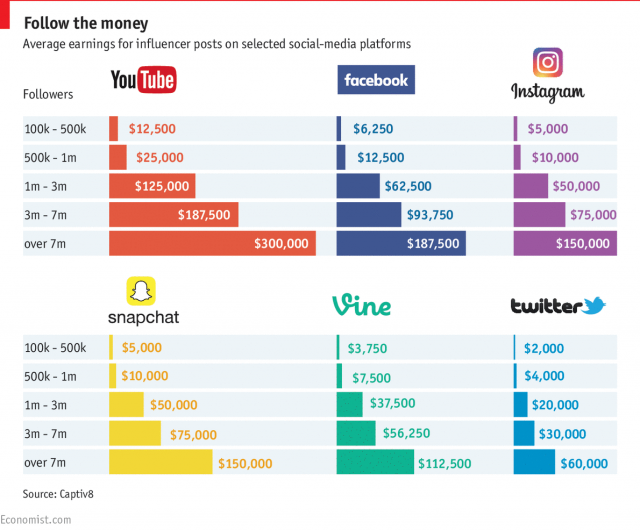

Big influencers attract thousands of dollars for just a post on social media

Only 3% of the marketers said they planned to cut back on influencer marketing in the coming year, versus about 75% who anticipated spending even more on it, says emarketer.com. Moreover, according to the website, companies are paying the most for celebrity posts, especially on certain platforms. On average, posts by celebrities with at least 1 million followers (considered as influencers) cost nearly £65,000 each ($87,731), with Facebook posts demanding a leading rate of approximately £75,000 ($101,228).

Influencer marketing costs are going up in the UK, according to research by Rakuten Marketing and Morar Consulting, but prices per post vary considerably depending on reach and platform. This month, polling of UK marketers working directly on influencer programs from sectors including fashion, beauty and travel, approximately two-thirds of respondents had seen the prices influencers charge for posts go up in the past 12 months. In some industries, the costs were even higher, with some premium fashion brands, for example, paying celebrity influencers more than £160,000 ($215,954) per post.

“UK marketers are willing to pay celebrity influencers on Facebook up to £75,000 for a single post mentioning the brand they want to promote, a new survey has revealed. They are also prepared to pay celebrity influencers £67,000 for each YouTube video that mentions their brand, while key influencers on Snapchat can expect to be paid as much as £53,000 per Snap,” writes www.warc.com.

Spending was much more modest for so-called micro-influencers—those with 10,000 or fewer followers, due to the fact that only a fifth (20%) of marketers claim they are able to demonstrate the impact of influencers through indirectly influenced sales. Prices averaged at close to £1,350 ($1,822) per post, with YouTube and Facebook commanding the highest prices—more than £1,500 ($2,025)—and Snapchat the lowest at just over £1,000 ($1,350).

“Decision makers questioned from across a variety of sectors including fashion, FMCG, beauty and travel admitted that they would shell out as much as £53,000 per Snapchat post, which despite coming in at significantly less than the value they placed on other platforms, is notable given that Snapchat’s ephemeral nature means videos and pictures disappear within 24 hours of being posted,” said Rebecca Stewart for thedrum.com.

Overall, respondents said they would devote an average of 24% of their marketing budgets to influencer marketing in the next 12 months. That figure’s higher than the share of budgets that the largest percentage of marketers in the UK and US said they devoted to influencer marketing in a March 2017 study by Econsultancy. In that study, between half and six in 10 luxury and non luxury brand marketers said they invested less than 10% of their overall marketing budgets to influencer marketing. But the second largest shares of respondents were similar in their spending allotment to those in the Rakuten and Morar study.

Affiliate marketing firm Rakuten Marketing spoke to 200 UK marketers working on influencer programmes and found that post-for-post they were prepared to pay 12% more for Facebook endorsements than they were for YouTube. The research also found that despite the value brands clearly place on high-profile influencer slots, the majority of those asked (86%) admit they aren’t entirely sure how influencer fees are calculated. Which is pretty odd, especially after the last years of change in the media buying market, the restriction of budgets and the overall risen caution.

Why are the influencers so important for marketers when it comes to social media? According to The Economist, social media offer brands their best opportunity to reach cord-cutting millennials: Snapchat, for instance, reaches 40% of all American 18- to 34-year-olds every day.

“Moreover, these platforms can make consumers feel they have gained unprecedented access to the lives of the rich and famous. That lets sponsors interact with their target audiences in ways that traditional advertising cannot match. In turn, demand from marketers for these channels has made social media lucrative territory for people with large online followings,” wrote the famous business magazine.

On the other hand, while 59 per cent of marketers state the influencers they work with will take guidance from them around best practice, 56 per cent of premium fashion marketers admit to a situation in which influencers hold all of the power. For example, only 20 per cent of marketers state influencers are prepared to follow their lead when it comes to guidance around billing.

Less than a third (29 per cent) believe that the influencers they work with are entirely concerned whether their content drives sales for the brand. Interestingly, when asked what would encourage marketers to invest more in an influencer programme, greater transparency and better reporting of influencer contribution to sales now rank as the highest factor (50 per cent).

James Collins, Rakuten Marketing’s SVP/managing director, global attribution, comments, “Influencer marketing can be hugely effective but marketers are commissioning expensive posts without understanding the real impact on the purchase journey. It’s essential that marketers question influencer fees and use attribution tools to measure the effect of this activity in order to create strong, value-driven relationships between brands and influencers.”

How the UK marketers feel towards the GDPR

Only 11% of marketers already have systems in place to ensure they don’t fall foul of the legislation, as shows data from YouGov and The Chartered Institute of Marketing (CIM). From May 2018, the EU General Data Protection Regulation (GDPR) will come into effect. The reform is one of the most significant in years at 200-pages long and formalizes concepts like the ‘right to be forgotten’, data breach accountability, data portability and more. Huge fines of €20m, or up to 4% of global revenues, have been threatened for non-compliance.

The study into the challenges and opportunities facing those in the industry was based on two separate surveys from YouGov and the CIM. Key findings from the former, which surveyed 225 marketers found that for those in the UK, Brexit (55%) and a recession (47%) were the top concerns for the year ahead. Only 13% of those quizzed said that GDPR would be a significant cause of worry, with just 31% admitting they do not know whether their business has taken steps to ensure they’re compliant.

source: The Chartered Institute of Marketing (CIM)

The CIM’s dataset from 112 members revealed that 70% of marketers are concerned about factors outside of their control, including data breaches, impacting on their brand. The introduction of GDPR will have huge ramifications for marketers who handle personal data and also place demands on businesses to demonstrate informed consent to use consumers’ personal data for marketing purposes – something marketers have previously expressed anxiety over.

Chris Daly, chief executive of the CIM said that while marketers were conscious of impending challenges like Brexit and other digital trends, they have to make sure it doesn’t obscure other issues.

“It is concerning to see that GDPR has not been fully considered, given the wide-reaching impact this will have on business areas which deal with data – marketers’ natural habitat. Given the concerns that emerged from consumers last year over how businesses collect and use customer data, marketers must make sure they are prepared and ready for GDPR sooner rather than later. By staying on the right side of the incoming legislation, marketers are best placed to safeguard not only their business’ reputation, but also its finances.”

The report, “The Challenges and Opportunities facing Marketers in 2017”, features the results of a YouGov survey of 255 marketers, in which more than half (55%) said the UK’s exit from the European Union was among their top concerns.

As a result of the UK’s looming constitutional changes, 54% of marketers said they expected to see an increase in “Brand Britain” messaging, and 19% said they were already looking at how to incorporate this into their own marketing.

Further data from a survey of 112 CIM members, conducted via Survey Monkey, reveals that:

- 70% of marketers are concerned about factors outside of their control (data breach, tax scandals, workers’ rights problems) impacting on the brand

- 95% think marketers need more influence and involvement with the broader business in order to protect brand reputation

Despite the influence social media gives consumers, only 18% of marketers are confident they can handle anything social media throws at them.

One of the key drivers for this is the impact of social media, which gives consumers a platform to shine a light on bad brand behaviour – in fact, 89% of marketers believe the Internet, and social media in particular, gives consumers more power to effect change over brands. However, 21% of marketers feel that while they can manage social media daily, they would struggle in the midst of a Twitter storm. Half of marketers (49%) also say they are not getting the most out of their social media, with 22% attributing this to a lack of investment. While marketers are trying to keep up with changing customer expectations, it would seem some are being held back by the business.

8 Things you might not know about Kjell Nordstrom

Kjell Anders Nordström is a Swedish economist, writer and public speaker. Amid the madness and hyperbole surrounding the new economy, Dr. Kjell A. Nordström is a guru of the new world of business. In 2009, Thinkers 50, the global ranking of management gurus, placed him and his partner Jonas Ridderstrale among the list of most influential thinkers. His research and consulting focus is on the areas of corporate strategy, multinational corporations and globalization.

More things about him that you might not know:

1.He was first educated as an engineer and thereafter commenced studies at the Stockholm School of Economics, where he earned a Ph.D. in 1991. Until 2004 he was an Assistant Professor at the Institute of International Business (IIB) at the Stockholm School of Economics. His research and consulting focus is in the areas of strategic management, multinational corporations and globalization. He has served as an advisor/consultant to several large multinationals and to the government of the United Kingdom.

2. He believes that in order to get rid of that human shadow called poverty, we have to make up our minds as to what a good life is. “Technology without ideology and values, does not produce much value. As noted by Charles Handy, the market is not a substitute for responsibility – merely a mechanism for sorting the efficient from the inefficient,” he declared for http://thinkers50.com.

3. Nordstrom also thinks that never before in the history of mankind have we had so many potent tools that potentially enable us to build a better world and companies that are actually fun to work for, but it is up to us to create this future.

4. In his opinion, the role of the leader is to strike a balance between when there should be control and when you should let go. Leadership is very much an art form.

5. His book “Funky Business – Talent Makes Capital Dance” became an international best-seller and has to date been translated into 33 languages. In 2000, both Amazon.co.uk and the webzine Management General rated it as one of the five best business books of the year. Another survey ranked it as the 16th best business book of all time.

6. He has been described as the “enfant terrible of the new world of business”.

7. He is a founder of the Stockholm School of Economics’ most prestigious management program, which attracts the elite of Scandinavian executives.

8. Amusing, Educational, Enthusiastic, Informal, Interactive, Passionate, Story-telling and Thought-provoking. Kjell Nordstrom is one of a new generation of rock star speakers. His dynamic, agile and compelling style is matched by the scale and pace of his ideas.