Blockchain Business News 8-14 March

This is the weekly wrap of blockchain business news for 8-14 March. Subscribe to get the blockchain news you need for your business!

An NFT Digital Artwork Just Sold For $69 Million

Last week, Christie’s sold the first purely digital artwork ever offered by an auction house.

The artwork is called Everydays: The first 5000 days and was created by digital artist Mike Winkelmann aka Beeple.

The piece is one massive image that contains every single everyday that he has done from May 1st 2007 to January 7th, 2021. ⠀

The NFT-based digital artwork sold for a whopping $69 million making Beeple the third most-valuable living artist in the world behind David Hockney and Jeff Koons.

View this post on Instagram

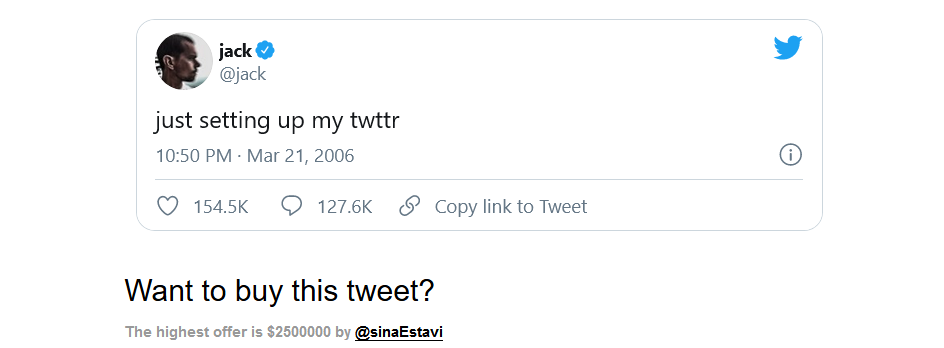

Thanks to NFTs, you can become the owner of a digital artwork, an NBA shot or a tweet.

Wait, a tweet?

Yes!

And not just any tweet, Jack Dorsey’s first tweet in 2006.

The auction is set to end on March 21. Jack announced he will donate the proceeds to Give Directly’s Africa Response fund for COVID-19 relief.

The highest bid for the tweet is currently $2.5 million.

Blockchain firm Ripple to end partnership with MoneyGram

In 2019, MoneyGram and blockchain firm Ripple announced a partnership where MoneyGram will distribute Ripple’s digital currency XRP across the world and Ripple will invest up to $50 million in MoneyGram. XRP, Ripple’s digital currency is the world’s third most valuable cryptocurrency after Bitcoin and Ethereum.

In its announcement, MoneyGram said it would use Ripple’s xRapid liquidity product to help process cross-border payments for an initial term of two years. As for Ripple, the main benefit of this deal is increased credibility for its digital currency.

Two years later, the companies have decided to end their partnership agreement.

In its statement, Ripple said:

We are proud of the work we were able to accomplish in a short amount of time, as well as the impact we were able to achieve in bringing this first-of-its-kind product to market. Together, we processed billions of dollars through RippleNet and On-Demand Liquidity (ODL).

We are both committed to revisiting our relationship in the future. We still believe in the promise of digital assets and blockchain technology to change the status quo in global payments for the benefit of billions of consumers around the world.

PayPal steps up crypto efforts with acquisition of blockchain security startup Curv

PayPal announced last week that it has agreed to acquire Curv to accelerate and expand its initiatives to support cryptocurrencies and digital assets.

Curv is a leading provider of cloud-based infrastructure for digital asset security based in Tel Aviv, Israel.

PayPal, now boasting 375 million consumers and $2.4 billion in profit for 2019, said in its statement that “The acquisition of Curv is part of our effort to invest in the talent and technology to realize our vision for a more inclusive financial system.”

Last year, PayPal announced its commitment to help shape the role that digital currencies will play in the future of financial services and commerce.

Blockchain.com Crypto Wallet outage affects ‘large number’ of users

On March 9, Blockchain.com, the world’s oldest crypto company, experienced an issue that prevented its users from accessing their wallets.

Upon investigation, the company reported that a fire at one of their many data centers had caused the outage. The issue was fixed eight hours later with wallet functionality being fully restored.

The demand for internet-based services has increased over the past few years. Businesses are now adopting cloud services and advanced technologies for operation, data storage and other related work. Blockchain technology is now a significant driver for data centre demand.

With data centres growing bigger and more powerful, the rate of fire incidents is also increasing. To prevent the type of outages that Blockchain.com experienced last week, data centers operators must adopt fire detection and suppression systems.

As this report mentions, the cost of IT equipment and downtime of the server room is much higher than the cost of the fire suppression system.

Blockchain.com to leverage the business experience and clout of Jim Messina, Obama’s former political and corporate adviser

Blockchain.com was launched in 2011. In the past decade, the company developed a popular cryptocurrency wallet as well as an exchange and an explorer.

According to the latest statistics, people have created 65 million wallets on the company’s website or using mobile apps. Since 2012, 28% of bitcoin transactions have been sent or received by a Blockchain.com-managed wallet. In February 2021, the company raised a $120 million funding round.

Jim Messina

Who is Jim Messina and why does Blockchain.com need his expertise?

Jim Messina is one of the world’s most successful political and corporate advisors.

He is the mastermind behind President Obama’s 2012 re-election campaign. Before crafting the strategy that would get President Obama re-elected, he spent a month learning organizational growth, marketing and emerging technologies from the CEOs of some of the most successful companies in the US: Apple, Facebook, Microsoft, Salesforce etc.

The press release announcing that Jim Messina will be joining the Blockchain.com Board of Directors also mentions the reason behind this decision:

“Jim’s experience and guidance will be invaluable as we navigate the process of bringing crypto to the first billion people.”

Australia’s Government Allocates $5.3M for Blockchain Pilot Projects

The government of Australia has allocated $5.3 million to the Department of Industry, Science, Energy and Resources to study the role blockchain technology can play in regulation.

The money will be spent on two pilot projects intended to show how cost reductions in regulatory compliance are possible with the use of blockchain. The projects will focus on the supply chains of critical minerals and food and beverages.

This news is not surprising with Australia being one of the top leading countries in blockchain technology.

Last year, Australia released its 5-year National Blockchain Roadmap in which it said it was exploring the potential benefits of blockchain to create new economic growth and improve productivity.

The roadmap delves into three main industries which it believes would benefit from applying blockchain: the agricultural sector, the education sector and the financial services sector.

Join the Conversation

We’d love to hear what you have to say.

Get in touch with us on our LinkedIn Page, Facebook Page, Twitter or TikTok.

Blockchain Business News 22-28 February

NBA Top Shot Moments, on-court video highlights minted on the blockchain, reached $200M+ in sales

Tired of collecting the same old baseball cards? It’s time to switch to basketball!

NBA provides basketball fans with a new kind of collectables: the Top Shot Moments.

With the Top Shot Moments, fans can collect and own the NBA’s greatest highlights.

Top Shot Moments are video clips of basketball plays with animations.

These clips are licensed by the NBA and minted on the blockchain in limited supply.

Each Moment has a nonfungible token (NFT), which is unique to that specific Moment. The NFT proves the authenticity of the traded Moment, and without the need to send physical memorabilia, the transfer is very quick.

NBA Top Shot Moments is the harbinger of a new era in fandom. In just over a week, sales increased by 100%, jumping to over $200 million.

The NBA Top Shot Moments experience was created by Dapper Labs, a consumer-focused blockchain developer.

Crypto.com to perform the largest token burn in history

source: crypto.com

Crypto.com is a pioneering payment and cryptocurrency platform. Founded in 2016 with the goal of promoting the widespread adoption of cryptocurrencies, Crypto.com already has over 5 million users.

In what the company has called the largest token burn in history, 70 billion CRO will be burned as an important step to fully decentralizing the Chain network.

It will also support the company’s launch of its CRO Chain Mainnet on March 25. The burn will increase the circulating supply of CRO from the current 24% to over 80%.

We’re looking forward to joining all ecosystem partner projects and all contributors in building the world’s best infrastructure for Payments, DeFi and NFTs.

Crypto.com

Automotive Blockchain Market Size Will Grow 30% to $2 billion by 2026

In 2019, the global Automotive Blockchain Market was approximately $300 Million.

The latest study reports that the market is expected to grow at a CAGR of 30% and is anticipated to reach around $2 billion by 2026.

Top market players are Ripple Labs Inc., Ethereum, Bigchaindb, Carblock, Consensys, Shiftmobility, IBM, Context Labs, Cube, Accenture and others.

What is the application of blockchain technology in the automotive market?

Blockchain technology in the automotive sector can be used to store and update information related to vehicle spare parts.

This helps the car manufacturer, service providers, and customers to track the origin of the part avoiding the selection of counterfeited products.

NFTs based on the show American Gods to roll out in the coming days

American Gods is a fantasy drama series based on Neil Gaiman’s novel of the same name. The show, now in its third season, is very popular, having won several prestigious TV awards to date.

Last week, Fremantle, the show’s producer, announced that they would roll out American Gods digital collectables, i.e. NFTs, in collaboration with Curio, a platform that allows fans to own, share or trade digital items in a manner akin to physical trading cards or collectables.

A spokesperson for Fremantle said the digital collectables are a new way for the show’s fans to “share and interact in a deeper and more meaningful way with the content and characters they love.”

State Bank Of India Joins Liink, JPMorgan’s Blockchain Network

J.P. Morgan is one of the global leaders in financial services. S&P Global ranked JPMorgan Chase as the largest bank in the United States and the 5th largest bank in the world by total assets.

Recently, J.P. Morgan has been increasing its commitment and interest in digital currency and blockchain. The bank established a business unit solely focused on blockchain development, called Onyx, in October. Liink is J.P. Morgan’s peer-to-peer blockchain-based data network, operating under Onyx.

Using Liink helps lower transaction costs and reduce the time taken to resolve cross-border payments-related inquiries from up to a fortnight to a few hours.

About 100 banks are live on the network now with State Bank of India being the latest to join Liink.

A research report from Bank of America found that 21% of banks they cover have incorporated blockchain technology into their businesses in some form.

Modulus introduces Blockchain-as-a-Service offering

Modulus is a US-based developer of ultra-high-performance trading and surveillance technology that powers global equities, derivatives, and digital asset exchanges.

Last week, the company announced that it released a Blockchain-as-a-Service offering.

What is Blockchain-as-a-Service?

Blockchain as a Service (BaaS) is a type of blockchain service offering that allows business customers to use cloud-based solutions to develop, host and adopt their own blockchain applications, smart contracts and other relevant functions on the blockchain.

The BaaS market is on the rise.

According to the latest reports, the global blockchain-as-a-service market size is set to reach $24.94 billion by 2027, exhibiting an impressive CAGR of 39.5% during the forecast period.

Huawei, Baidu, Oracle, IBM, Alibaba are among the key companies operating in the BaaS market.

Modulus’ BaaS offering is blending a mix of image recognition and other types of bio-inspired AI together with blockchain technology.

“Our solution can verify that a distinct event happened at an exact time, by a specific person in a particular location. It really is next-generation verification in every sense of the concept,” explained Richard Gardner, CEO of Modulus.

Quote of the week

Peter Thiel (thielfoundation.org)

PayPal had these goals of creating a new currency. We failed at that, and we just created a new payment system. I think Bitcoin has succeeded on the level of a new currency, but the payment system is somewhat lacking. It’s very hard to use, and that’s the big challenge on the Bitcoin side.

Peter Thiel, Co-Founder of PayPal (source)

Join the Conversation

We’d love to hear what you have to say.

Get in touch with us on our LinkedIn Page, Facebook Page, Twitter or TikTok.