Blue Ocean Strategy is a highly effective approach to developing innovative strategies that capture new market spaces and drive business growth.

In this article, we explore the application of the Blue Ocean Strategy to the finance industry, examining its key principles, tools and real-world examples.

By understanding Blue Ocean Strategy and its potential for unique insights and opportunities in finance, companies can develop strategies that pave the way for future growth and success.

Table of Contents

Understanding Blue Ocean Strategy

The Blue Ocean Strategy is a revolutionary concept that has been introduced by W. Chan Kim and Renée Mauborgne in their book “Blue Ocean Strategy: How to Create Uncontested Market Space and Make Competition Irrelevant.”

The Blue Ocean Strategy is a framework that businesses can use to identify and create new market spaces that are uncontested, thereby creating a “blue ocean” of opportunity.

Renée Mauborgne spoke at BRAND MINDS about adapting the Blue Ocean Strategy to reach new markets in 2023, live, on stage.

Origins of Blue Ocean Strategy

Blue Ocean Strategy is based on a 10-year study of strategic business moves across 30 industries.

What prompted this study?

Seeing American companies lose customers and market shares, in the early 1990s, to a new competitor who was coming from outside of the country: Japanese companies.

Global competition was changing everything for companies anywhere in the world. The markets were becoming crowded. For the first time since World War II, demand didn’t exceed supply. Businesses were entering a new era and the old business strategies were becoming obsolete. It was time to design new business strategies.

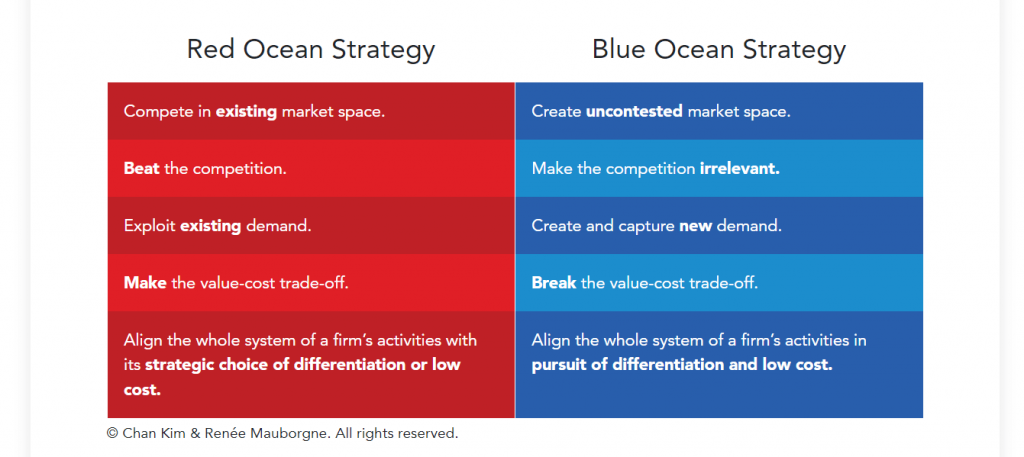

Blue Ocean Strategy was developed as an alternative to the traditional approach to strategy formulation, which focused on beating competitors to gain a larger share of an existing market (red ocean strategy).

The authors say that in order for businesses to grow and thrive, they needed to focus on creating new market spaces that were untapped and uncontested. They argued that the key to success in business was not just to compete with rivals, but to create new markets where competition is irrelevant.

The authors analyzed the strategies of companies which became successful by creating new market spaces that were uncontested, and by offering innovative products or services that were not available in the existing market.

Key Principles of Blue Ocean Strategy

Blue Ocean Strategy is founded on several key principles that guide businesses in their pursuit of new market spaces:

| BLUE OCEAN STRATEGY KEY PRINCIPLE | HOW TO APPLY IT |

|---|---|

| Focus on creating new markets, rather than competing in existing ones. | Identify areas where there is little or no competition. Develop products or services that meet the needs of customers in those markets. |

| Use innovation to create value that is not present in the current market. | Develop new products or services that are different from those currently available in the market, and that offer unique benefits to customers. |

| Break free of market boundaries to create new opportunities. | Look beyond the existing market. Identify new customer groups or applications for your products or services. |

| Align your value proposition with customer needs and preferences. | Understand the needs and preferences of your target customers. Develop products or services that meet those needs and preferences. |

Red Ocean vs. Blue Ocean Strategy

The red ocean strategy focuses on competing within an existing market space, attempting to gain a higher market share than competitors. This approach is often characterized by intense price competition and commodity-like products.

In contrast, the Blue Ocean Strategy aims to create a new market space that is uncontested, thereby avoiding the need for cutthroat competition and price wars. This can lead to higher profits and growth, as businesses are able to offer unique products or services that meet the needs of customers in untapped markets.

Additionally, the Blue Ocean Strategy can help businesses to differentiate themselves from competitors, and to build a strong brand that is associated with innovation and creativity.

Overall, the blue ocean strategy is a powerful tool for businesses that are looking to grow and expand their operations and achieve long-term success and profitability.

2023 Finance Industry Statistics

The finance industry is a highly competitive market space. Here is a condensed outlook on the financial services industry:

- The financial services industry constitutes at least 20% of the global economy and the impact of the financial sector on economic growth is significant (Economist Intelligence Unit);

- The global financial services market grew from $25 trillion in 2022 to $28 trillion in 2023 at a compound annual growth rate (CAGR) of 8.8% (Financial Services Global Market Report 2023);

- Products and services provided by the Finance industry: lending, payments, insurance, investments, foreign exchange services, personal money management, wealth management, and investment banking;

- Western Europe was the largest region in the financial services market in 2022, North America was the second-largest region (Financial Services Global Market Report 2023);

- FinTech (financial technology): The financial services sector’s adoption of digital technology has been accelerating over the past few years (blockchain, Artificial Intelligence and Machine Learning, cloud computing a.s.o.);

- Financial services providers are using FinTech to improve customer experience, reduce costs and increase operational efficiencies: online banking, virtual advisors, automation, anti-fraud systems, money management apps, cash back rewards, contactless payments, chatbots a.s.o.;

- FinTech can help financial services companies provide innovative products and solutions to their customers;

- Trends: digital currencies, NFTs, neo-banks (digital-only banking), mobile wallets, big companies developing financial services (Facebook Pay, Google Wallet, Apple Card, Walmart’s financial solutions to customers and employees).

Blue Ocean Strategy Tools and Frameworks

The Blue Ocean Strategy is a business theory that suggests companies should create uncontested market space, making the competition irrelevant.

To apply the Blue Ocean Strategy effectively, businesses can leverage a variety of tools and frameworks. These include:

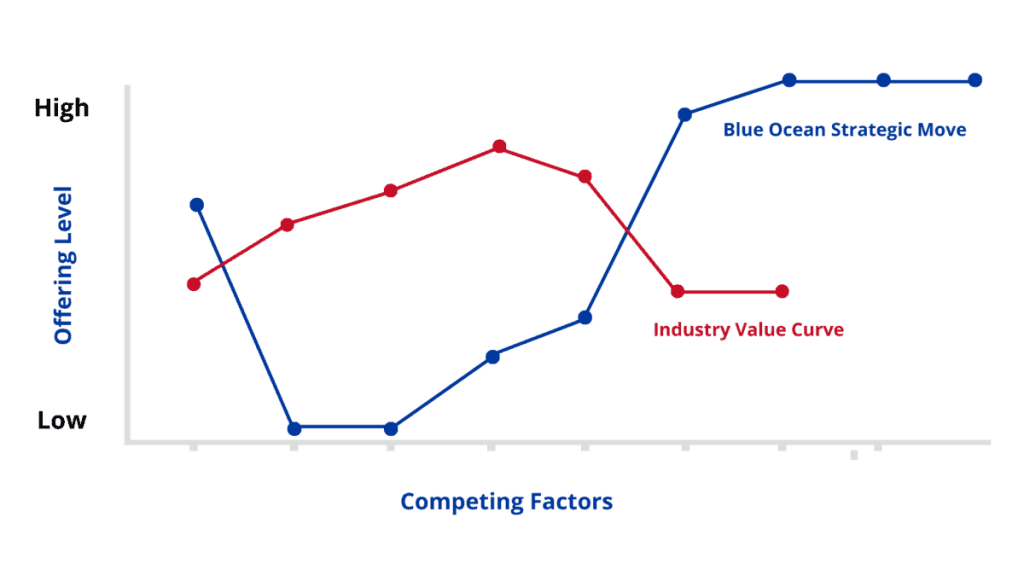

Strategy Canvas

The Strategy Canvas is a tool that allows companies to identify in one simple chart the current and future market opportunities. By plotting two lines on a chart – one with the industry average and one with the potential for creative strategies – companies are able to grasp how to grow their business without fighting the competition.

For a financial service company, the strategy canvas can be used to compare the company’s value proposition to that of its competitors. The company may find that its competitors are all offering similar products at similar prices. However, the company may identify that its competitors are not offering online options. By adding online options to its services, the company can create a unique value proposition that differentiates it from its competitors.

Four Actions Framework

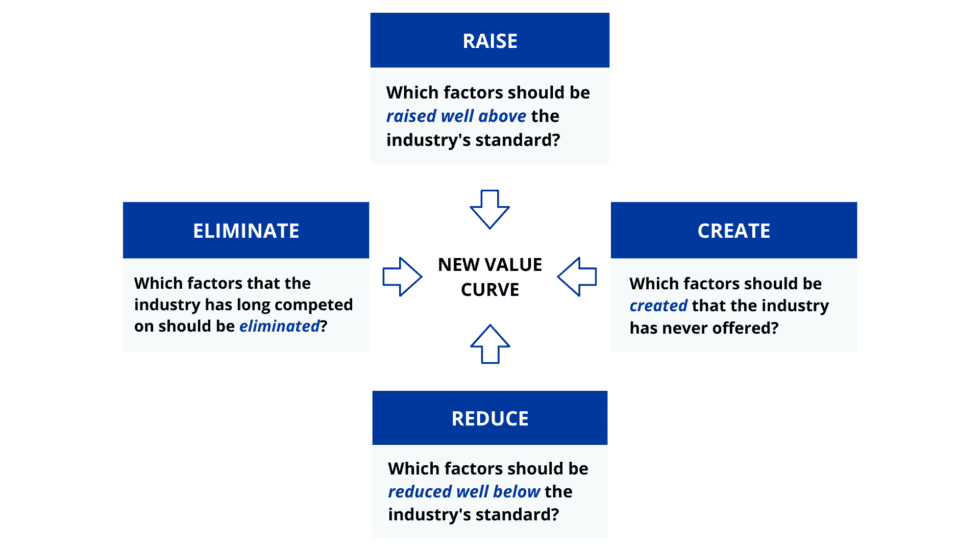

The four-actions framework is a tool that helps businesses to identify and eliminate factors that are currently taken for granted in their industry, while simultaneously identifying new factors that can be introduced to create a unique value proposition.

The framework asks four key questions:

- Which factors that the industry takes for granted should be eliminated?

- Which factors should be reduced well below the industry’s standard?

- Which factors should be raised well above the industry’s standard?

- Which factors should be created that the industry has never offered?

By answering these questions, companies can identify new opportunities for differentiation and create a unique value proposition that sets them apart from their competitors.

The Strategy Canvas and Four Actions Framework are just a few examples of tools and frameworks that companies can use to create blue oceans. The complete list of Blue Ocean Strategy tools and frameworks is comprised of the following:

- Value Innovation

- Strategy Canvas

- Buyer Utility Map

- Three Tiers of NonCustomers

- Six Paths Framework

- Four Actions Framework

- ERRC Grid

- PMS Map

- Price Corridor of the Mass

- Sequence of Creating a Blue Ocean

- Five Steps to a Blue Ocean Shift

- Three Components of a Blue Ocean Shift

- Three Components of Humanness

- Four Hurdles to Strategy Execution

- Fair Process

Applying the Blue Ocean Strategy to the Finance Industry

How Financial services companies can leverage the blue ocean strategy:

Identify untapped market spaces by examining the needs and preferences of noncustomers the other banks ignore.

6 steps to identify untapped markets

- Identify noncustomers i.e., people who don’t currently use your bank or any other bank through market research surveys or questionnaires.

- Analyze noncustomers’ needs and preferences by asking questions about their financial needs and what they look for in a bank.

- Analyze the competition to identify gaps in the market that aren’t being addressed ( what other banks are doing and what they are not doing to meet the needs of noncustomers)

- Create a value proposition based on the needs and preferences of noncustomers and the gaps in the market.

- Test the value proposition through surveys or focus groups.

- Develop a marketing strategy that targets noncustomers and communicates the value proposition effectively.

Examples: The French bank Compte-Nickel focused on low-income earners and people facing financial exclusion. The bank was successfully sold to BNP Paribas for over 200 million euros in 2017.

Overcome industry boundaries by including services that are traditionally provided by other industries.

Another way to apply the blue ocean strategy to finance is to break free of traditional industry boundaries.

For example, businesses can expand their offerings to include services that are traditionally provided by other industries, such as technology or healthcare. This can create new market spaces that are uncontested, and allow for more innovative and diverse offerings.

One example of this is the use of blockchain technology in finance. By leveraging blockchain technology, financial institutions can create secure and transparent financial transactions that are not dependent on traditional banking systems. This can create a new market space for financial institutions that are willing to invest in this technology.

Create value innovation by leveraging technology, social trends, and customer preferences to develop unique products or services at low costs.

Revolut is a great example of building a blue ocean market by creating value innovation.

Launched in 2015, FinTech company Revolut is currently Europe’s most popular online bank valued at $33 billion. Revolut started as a financial service for travellers who paid excessive foreign transaction fees. After failing to find a bank that would cover multiple currencies, Storonsky and Vladyslav Yatsenko (co-founder and CTO) left their jobs at Credit Suisse to solve this issue.

Revolut has created value innovation by providing customers with a service (global currency exchange) for free (Revolut doesn’t charge any fee for currency exchange). Today Revolut offers several new services including international travel insurance, cryptocurrency, cashback rewards, loans, stocks and money management.

Their latest service is Stays, a feature allowing customers to book holidays directly from the Revolut app. Another strong benefit of Revolut is its great accessibility and easy-to-use app.

Overall, the blue ocean strategy offers a powerful tool for financial institutions looking to differentiate themselves in a crowded and competitive market space. By identifying untapped market spaces, breaking free of traditional industry boundaries, and creating value innovation, financial institutions can drive growth and profitability while also meeting the evolving needs and preferences of their customers.

Real-world examples of Blue Ocean Strategy in Finance

Many businesses have successfully implemented the blue ocean strategy in finance, resulting in significant growth and profitability.

Some examples include:

- Studio Bank in Nashville, Tennessee is designed for creators (artists, photographers, musicians, builders, and writers).

- Chickasaw Community Bank is a bank for Native Americans.

- Lili is a banking platform for freelancers.

- Ellevest is a banking platform for women.

- Kontist offers banking products specifically tailored to the needs of freelancers in Germany.

- Ando Money is a banking platform for those who want to fight climate change.

- Coconut is a bookkeeping and tax app for sole traders.

- Klarna is a Swedish bank providing leading global payments for shoppers.

Conclusion

The blue ocean strategy offers a powerful framework for companies in finance to identify new and uncontested market spaces that drive growth and profitability.

By applying the key principles of the blue ocean strategy, financial service companies can create innovative financial services that provide customers with unique value propositions and pave the way for future growth and success.