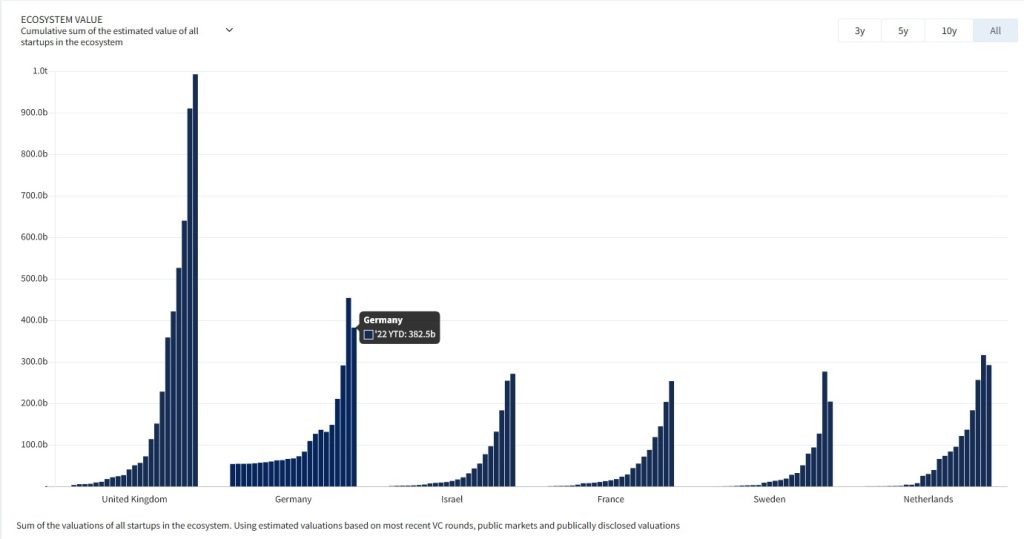

The UK continues to be the #1 tech hub in Europe, in 2022, home to 131 tech unicorns and 228 future tech unicorns to date.

Recent reports estimate a $1 trillion valuation for the U.K.’s startup and scaleup ecosystem, with fintech leading the way as the industry attracts the most money from VCs.

Tech ecosystem value in European countries

(source Dealroom)

THE UK’S TECH ECOSYSTEM – STATISTICS (source: Dealroom)

- Top 3 industries by value: Fintech (48.1 billion US dollars), Health (28.6 billion US dollars), Enterprise Software (20.1 billion US dollars)

- 607.000 employees

- 133.6 billion US dollars in VC funding since 2015

- 15.000 funding rounds since 2015

- 40.000 startups

- 23.000 startups founded in the last 10 years

THE UK’S NEW 2022 TECH UNICORNS

5ire – The world’s first sustainable blockchain

Current valuation: 1.5 billion US dollars

Total funding: 121 million US dollars

5ire investors: SRAM & MRAM Group, Oracle Investment Management, Alphabit Fund, Marshland Capital, Moonrock Capital, Launchpool, Magnus Capital, Sanctum Global Ventures

Tech startup 5ire is just one year old and already a unicorn! Its co-founders are Pratik Gauri, Prateek Dwivedi and Vilma Mattila.

In a recent interview, 5ire CEO Pratik Gauri said that their primary goal starting out was to “impact a billion people positively.”

How are they going to achieve that?

By building a scalable decentralized, open-source blockchain for Impact & SDG-related development, to help accelerate the United Nations 2030 Agenda for Sustainable Development.

“Our goal is to work hard to provide finance platforms that could potentially revolutionize access to capital and unlock potential for new investors in projects that address environmental challenges”, says the 5ire team.

What is 5ire’s current challenge and what is the company doing to overcome it?

Here’s what 5ire co-founder & CEO Pratik Gauri answered:

Founder & CEO Pratik Gauri

Human Capital is a big challenge in the web3 / blockchain space. Since we are using rust to develop a sustainable blockchain with a unique consensus called Proof Of Benefit, it’s been a challenge to find rust developers.

To overcome this, we’ve started a 5ire digital university to train developers on rust/substrate and hire them in-house.

Multiverse – The UK’s first-ever EdTech unicorn

Current valuation: 1.7 billion US dollars

Total funding: 414 million US dollars

Multiverse investors: Lightspeed Venture Partners, Index Ventures, Salesforce Ventures, General Catalyst Partners, D1 Capital Partners and others.

Tech unicorn Multiverse provides high-quality apprenticeship programmes that combine work, training and community. Its mission is to create a diverse group of future leaders; its focus is on developing new skills and competencies for the digital economy.

Multiverse was founded by Euan Blair in 2016 and has grown across the UK, training over 5,000 apprentices in partnership with more than 200 of the world’s best employers.

Multiverse helped many industry leaders close the skills gaps within their workforce and grow retention including global leader in financial services Morgan Stanley, Big Four accounting organization KPMG and Global Investment Bank and Financial Services Citi.

In June 2022, the EdTech unicorn announced the closing of $220m Series D funding and highlighted the following great results:

- Its software engineering program has seen a 260% increase in enrolments while maintaining a completion rate of 85%;

- The number of partners has grown by 105%;

- Since 2020, Multiverse has grown 9x in size;

- The company now trains professional apprentices with over 500 organizations globally, including Verizon, Cisco, Visa and others;

- Of the apprentices they have placed, 56% are people of color, more than half are women, and 34% hail from economically underserved communities;

- 68% of their apprentices are promoted either during their program or at its conclusion;

- 90% find permanent employment, either at their employer or within their industry.

Paddle – The complete payments infrastructure provider for SaaS companies

Current valuation: 1.4 billion US dollars

Total funding: 291 million US dollars

Paddle investors: Silicon Valley Bank, Notion Capital, Kindred Capital, Business Growth Fund, 83North and others.

Paddle offers an all-in-one payment solution to SaaS companies looking to permanently offload the burden of managing payments and the associated liabilities.

The tech unicorn is a software expert providing SaaS businesses with Merchant of record (MoR) services allowing them to grow more quickly (learn about MoR).

Founded in 2012 by Christian Owens and Harrison Rose, Paddle has over 3000 customers and 350 employees in 17 countries. The tech unicorn has marked its ten-year anniversary with the acquisition of ProfitWell, the leading provider of subscription metrics and retention software.

Entering the second decade of its existence, curious minds might ask: Does it get any easier?

Paddle CEO Christian Owens answers: “It doesn’t get easier, the problems just change”.

Forterro – Group of ERP software and services companies serving small to midmarket companies around the globe

Current valuation: 1.1 billion US dollars

Total funding: N/A (Battery Ventures acquired Forterro for 1b euros in 2022)

Forterro investors: Battery Ventures

With a European portfolio of specialised ERP (enterprise resource planning) software products and a global ecosystem of IT solutions and services, Forterro is a partner to more than 10,000 midmarket manufacturing and production companies.

Forterro operates product companies headquartered in Germany, France, Sweden, Switzerland, Poland, and the UK, as well as regional service hubs and development centers around the world.

In July 2022, Forterro announced the acquisition of Wise Software, a provider of ERP software solutions for industrial companies with retail, wholesale, eCommerce, and distribution requirements with 30 years in the UK market.

Payhawk – Credit cards, payments, expenses and cash combined into one integrated platform

Current valuation: 1 billion US dollars

Total funding: 236 million US dollars

Payhawk investors: Greenoaks Capital Partners, Lightspeed Venture Partners, Endeavor Catalyst, HubSpot Ventures, Earlybird Digital East Fund and others.

Fintech Payhawk offers all-in-one financial software to control company spending and save money. A report from the tech unicorn shows that scale-ups typically save up to 8,417 euros/month, SMBs, 1,015 euros and enterprises, 20,792 euros.

With Payhawk, small businesses manage, control and automate tedious administrative tasks, scale-ups keep spending under control and are encouraged and supported to undertake international expansion in more than 30 countries and enterprises transition to a paperless digital environment.

The UK fintech unicorn was founded in 2018 by Hristo Borisov, Konstantin Djengozov and Boyko Karadzhov. Their aspiration is “to become the world’s biggest bank without holding a single dollar”.

Their vision of the future is a world where “businesses can discover, manage and use multiple payment instruments (debit cards, credit cards, bank account etc.) powered by a single experience regardless of where money is kept.”

Tripledot Studios – Independent mobile game developer

Current valuation: 1.4 billion US dollars

Total funding: 202 million US dollars

Tripledot Studios investors: Velo Partners, Eldridge, Access Industries, The Twenty Minute VC (20VC) and Lightspeed Venture Partners.

Tripledot Studios is a fast-growing studio, led by a team of industry veterans from some of the biggest names in mobile games.

The tech unicorn was founded in 2017 by Akin Babayigit, Eyal Chameides and Lior Shiff. Their goal is to create fun, successful games for everyday gamers. The team’s guiding belief is that “when we love what we do, what we do will be loved by others. Together, we create games we know our players will enjoy, from easy-to-pick-up casual games to groundbreaking innovative ones.”

In a profile article in Forbes, the team shared that the company did $200 million in revenue last year on an estimated profit of around $30 million with over 30 million monthly users enjoying their games. Tripledot’s biggest hit is Woodoku, a combination of Tetris and sudoku. It launched in 2020 and has since been downloaded 100 million times.

I asked Tripledot Studios COO Akin Babayigit what is the company’s biggest challenge today and what is the team doing to address it.

Co-Founder & COO Akin Babayigit

Tripledot has been very fortunate to be growing leaps and bounds over the past few years, in an industry as highly competitive as mobile gaming.

As a growing organisation, our biggest challenge is to continue hiring the best & the brightest minds to become Tripledotters.

We saw in our previous experiences that growing organisations may tend to lower the quality bar for new hires as the pressures of growing become more pronounced. We don’t want to sacrifice our track record of hiring the best and the brightest minds, so our hiring bar remains exceptionally high. That probably is our biggest challenge at the moment.

Accelerant – Insurtech Unicorn with an Excellent (A) credit rating

Current valuation: 2 billion US dollars

Total funding: 190 million US dollars

Accelerant investors: MS&AD Ventures, Altamont Capital Partners and Eldridge.

Accelerant is a data-driven, technology-fueled insurtech that empowers underwriters with superior risk exchange, advanced data analytics, and long-term capacity commitments.

The company’s technology platform, InsightFull™, allows customers to spot small issues early before they become big problems.

Accelerant was founded by insurance industry veterans Jeff Radke and Chris Lee-Smith. They are joined by a team of professionals who understand the challenges of dealing with conventional carriers. Accelerant is Property and Casualty focused with a portfolio containing Hospitality, Arts & Entertainment, InsurTech, Habitational, Construction, Retail, Mercantile, Service, Trade, Surety and Warranty.

Ceres Power Holdings – World-leading developer of low-cost, next-generation fuel cell technology that creates a real-world energy solution

Current valuation: 1.2 billion US dollars

Total funding: 252 million US dollars (per Crunchbase)

Ceres Power Holdings investors: University of Bristol Enterprise Fund, Imperial College London, Parkwalk Advisors, Advanced Propulsion Centre UK, Investec and Berenberg (Germany).

Ceres Power Holdings is a clean tech unicorn, one of the leading developers of fuel cell technology in the UK. With 21 years of experience developing green technology, the company’s ultimate purpose is to help sustain a clean, green planet by ensuring there is clean energy everywhere in the world.

In recent news, Ceres has partnered with Shell to deliver a megawatt-scale electrolyser demonstrator for the production of low-cost, high-efficiency green hydrogen.

Ceres’ solid oxide fuel cell (SOFC) technology shows an essential role in significantly reducing CO2 emissions.

Smart Metering Systems – Provider of multi-utility infrastructure connections and meter asset management solutions

Current valuation: 1.6 billion US dollars

Total funding: N/A

Smart Metering Systems investors: N/A

Smart Metering Systems is working closely with private and public sector partners to decarbonise the UK economy by 2050.

They are a fully integrated energy infrastructure company which owns, installs, and manages carbon reduction (CaRe) assets, including smart meters, battery energy storage systems (BESS), and EV chargepoints.

Smart Metering Systems use its technology expertise, asset funding capability, and deep engineering skills to provide sustainable energy solutions for customers.